The credit-GDP ratio in Brazil: history and international comparison

The world has come a long way in measuring economic variables. This information is essential to guide economic management and business decisions. In the case of credit, one of the main sources is the “Monetary and Credit Statistics” report, published monthly by the Central Bank, with detailed figures on the types of loans contracted, default levels and interest rates.

These figures provide a good measure of the size of the credit market in Brazil. According to the monetary authority, the balance, published in August this year, of credit operations with the National Financial System (SFN)* is four trillion, three hundred billion reais. We're not used to thinking about figures that high, but a comparison might help: the figure represents 52.3% of Brazil's Gross Domestic Product (GDP) - or just over half of everything produced in the country over the course of a year.

Calculating credit as a proportion of GDP indicates the importance of credit in relation to the size of the economy, allowing comparisons to be made between countries. In economies where credit is dictated by the market, If the ratio is high, it demonstrates the maturity of credit discipline in the evaluation process, in competition and in the legal security of guarantees; if it is very low, there is room for the credit market to evolve, benefiting the economy and social welfare.

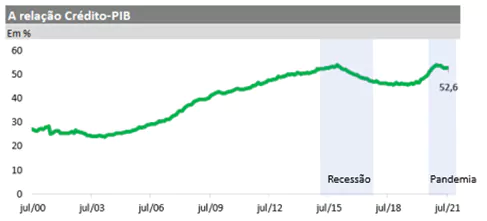

Representing just over half of our GDP, what can we say about the size of the Brazilian credit market? The answer requires a look at recent history and international figures. Let's first look at how this relationship has evolved over time. At the beginning of the 2000s, the balance of credit operations represented approximately a quarter of GDP. Throughout that decade, this percentage grew, surpassing the 50% mark for the first time in 2013.

The graph below shows the evolution of credit as a proportion of GDP over the last two decades. It highlights the decline observed until mid-2018, when the economy was still experiencing the hangover of a recession, and the more recent growth, driven by measures to combat the pandemic and the fall in GDP in 2020.

More than just growth, there has also been a change in the profile of credit granted, with an increase in the share of resources going to individuals and an increase in the presence of credit provided by private banks. In short, between ups and downs, credit as a proportion of GDP has practically doubled in the country over the last few decades.

This progress is attributed to the creation of institutional innovations that have brought more security to the market, favoring both those who seek it and those who grant it. A frequently mentioned example is the creation of payroll loans, which today account for a significant share of credit to individuals.

A look back shows the growing importance of loans and financing for the Brazilian economy. It remains to be seen whether there is more room for the credit market to grow. At this point, it's worth looking at what's happening in the rest of the world.

There are various metrics for evaluating the relationship between credit and GDP, each considering different credit instruments such as loans, financing and debt securities. For international comparison, the World Bank indicator is the most widespread. In this metric, domestic credit to the Brazilian private sector reached 70% of GDP in 2020. On the world average, this figure is much higher, reaching 216% in the United States and more than 124% in Chile.

To encourage credit in a sustainable way, there is room for improving discipline through greater competition, improving the assessment of borrowers and improving the use of guarantees.

At the moment, credit growth estimates are well above GDP growth estimates, This points to an improvement in the relationship between these variables. This expectation is in line with a series of transformative measures, encouraged and supported by the credit bureau sector, which we have discussed here.

The bureaux sector has collaborated to build a regulatory environment favorable to credit management, based on the understanding that a large and solid credit market can foster development, and that the design of good rules matters, as witnessed by the institutional changes that have favored the advancement of credit in recent decades.

To see how important good rules are, we can use the recent example of the Positive Registry (CP). Two years after the CP model was reformulated, the evidence suggests that this instrument has contributed to a reduction in spreads, as well as to the financial inclusion of the unbanked.

This measure and countless others, such as encouraging competition in the banking market and financial education actions, are more than temporary stimuli: they are structural changes with the potential to make the credit market grow on a sustainable basis and bring the country closer to the international average.

*The National Financial System (SFN) is made up of a group of entities and institutions that promote financial intermediation, i.e. the meeting between creditors and borrowers. It is through the financial system that people, companies and the government circulate most of their assets, pay their debts and make their investments.

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor