With 5 years of operation, Cadastro Positivo confirms economic and social benefits for Brazilians

The program's automatic adhesion model came into force in 2019

With 167 million unique records in its database, the Positive Registry (Law 12,414 of June 9, 2011, as amended by Complementary Law 166 of April 8, 2019) is five years into its automatic adhesion model, consolidated as a right for Brazilians and recognized for its benefits.

According to data from the National Association of Credit Bureaus (ANBC), the entity that brings together the bureaus that manage the Cadastro Positivo database (Equifax | Boa Vista, Quod, Serasa Experian, SPC and TransUnion), 87,17% of the economically active population currently participate in the program.

The purpose of the CP is to help assess risk when granting credit by providing positive information, which has a double benefit. On the one hand, it gives lenders a clearer view of borrowers' financial behavior and allows them to offer more favorable credit conditions for each profile. On the other hand, the initiative has made it possible for individual and corporate consumers to gain visibility for credit, promoting the democratization of access to financial resources.

Implemented in stages, after the successful inclusion of information received from financial institutions, telecommunications and electricity concessionaires, the Positive Register is now in its fourth phase, which involves the entry of sanitation companies.

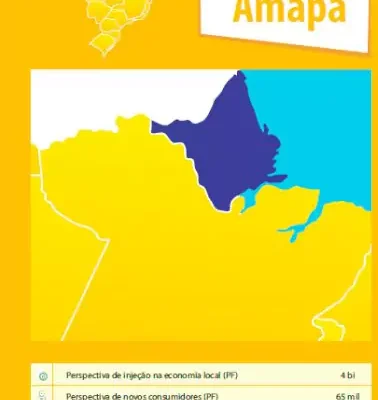

“We have reached the five-year mark with very positive results and with the capacity to improve the equity of participation among the states whose adhesion rates still have potential for expansion. That's why we're working actively at the moment to engage and get the sanitation sector on board, which, thanks to its capillarity, can include up to 55 million records in the Cadastro Positivo database, contributing to this balance,” says Elias Sfeir, president of ANBC.

Among the proven benefits of the Positive Registry over the last five years is the improvement in the credit rating, an indicator which, the higher it is, allows for fairer credit conditions. According to ANBC data, with the use of the Positive data, 78% of the economically active population registered an improvement in their score. In addition, the program has enabled more than 20 million individuals and companies to gain visibility for credit.

“These figures are reflected in the recognition of the importance of the Positive Registry by Brazilians. Proof of this is that of the small number who opted out of the program, 81% have already returned to the database,” adds Sfeir.

In the view of Rodrigo Maia, President of the National Confederation of Financial Institutions (CNF), “the Positive Registry in 2019 was one of the major items on the economic agenda that we approved in the National Congress when I was President of the Chamber of Deputies. The Positive Registry enabled millions of Brazilians to access cheaper credit and benefited good payers. An agenda that stimulated competition, boosting our economy.”

For Tadeu Silva, president of Acrefi (National Association of Credit, Financing and Investment Institutions), the program represented a victory for the financial market. “Over these five years, the dynamics of credit have changed, and clients have had their credit history assessed more accurately. Since then, the market has been able to rely on more data to grant safer credit. As a result, the Positive Registry has expanded the customer base and increased the volume of credit granted, bringing greater financial inclusion to those who lacked credit visibility. We believe that, with the evolution of the Positive Registry, we can reap greater gains for the entire market in the future.”

In celebration of the five years of the Positive Registry, the CNF, Acrefi and ANBC held an event in São Paulo on Tuesday with the presence of Roberto Campos Neto, President of the Central Bank. The full broadcast will be available on the ANBC channel at YouTube.

ANBC Press Relations

Regina Pimenta: (11) 98136.6835 regina@pimenta.com

Ana Carolina Rodrigues: (11) 98674.0348 anacarolina@pimenta.com