National data shows a lasting cycle of credit growth for families in Brazil. Projections for 2025 indicate a growth of 9.3% in the balance of credit to individuals, according to the Monetary Policy Report. However, due to its size, the country has very diverse realities. The aim of this article is to highlight regional data, as well as the specificities of the credit market in each region.

According to data from the Central Bank, in the comparison between July 2025 and the same month last year, credit for individuals grew in all regions of the country. The highest growth rate was recorded in the North, which saw an increase of 8.4% in real terms, i.e. discounting inflation. The accelerated growth of credit in the North is a reflection of the economic dynamism seen in the region, especially throughout 2024. In the Northeast, the advance was 7.7%.

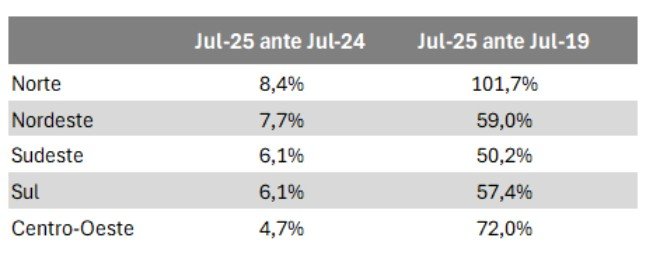

Broadening the horizon of analysis, data from the Central Bank shows that credit has advanced significantly in all five regions since before the pandemic. In the comparison between July 2025 and July 2019, credit growth in the North region was 101.7% in real terms. This region led credit growth over the period. Next came the Midwest, with an increase of 72.0%. The table below shows the growth in credit to Individuals by region, considering the most recent evolution, between July 2025 and July 2019, and the evolution since July 2019, in the period before the pandemic.

Each region has specific characteristics that shape credit data. In the South, for example, the importance of cooperative credit is well known. According to the Panorama of Cooperative Credit, In the South, these institutions are present in 95% of the region's municipalities. In addition, the South has the highest percentage of the population associated with credit unions: 24.6%. The Midwest, which has the second highest percentage, has 11.1%. In the Northeast, the performance of public banks and the presence of microcredit stand out, as already highlighted in a previously published text.

It is also worth looking at the sustainability of credit growth in each region. In other words, how have the default indicators evolved? According to data from credit bureaus, the Midwest has the highest percentage of consumers in default, with around 46.11% of the adult population in default. This is followed by the North, with 45.1%. The South has the lowest default rate: 38.01% of the adult population. In the Southeast, the percentage is 43.21 PTT3T, while in the Northeast it is 43.51 PTT3T.

Rising default rates could mean a limit to credit expansion. Over the last few months, the number of people with bad debts has been growing in the country as a whole, despite the rise in income and low levels of unemployment, as you saw in the latest article.

It is against this backdrop that the credit bureau sector has maintained an open dialog with regional leaders with the aim of encouraging the sharing of data to increase access to credit in a sustainable way. The more relevant information there is, the greater the visibility of credit for local individuals and companies and, consequently, greater clarity tends to favor the granting of credit with the financial sustainability of operations.

Well granted credit favors the borrower, who can obtain more favorable interest conditions and keeps the financial system more solid, as well as being a vector for development and reducing regional inequalities.

Thanks for reading! Access other content at ANBC website.