Source: https://gazeta24h.com/ - By: Sabrina Vasconcellos

Record debt in Brazil leads banks to rethink financial inclusion

- In 2023, the Central Bank of Brazil approved Joint Resolution No. 8, obliging financial institutions to offer financial education initiatives

- Now, banks are introducing smart new ways to increase financial education through their apps

Brazil has reached the mark of 200 million people with some kind of relationship with the financial system. However, more than three quarters of the population (76.1%) are in debt, a scenario that rekindles the debate about what quality financial inclusion really means. This was the warning made by the National Association of Credit Bureaus (ANBC) to the G20 in February, which has led to a change in mentality both in government and among banks: to go beyond exclusivity and prioritize financial education and long-term financial health.

“Without financial education, there is no real financial inclusion,” says Enrique Ramos O'Reilly, president of Moneythor in the Americas. “Opening a bank account should be seen as the first step, not the end goal.”

This understanding has been reinforced by the Central Bank of Brazil which, in 2023, published Joint Resolution No. 8, establishing new guidelines for financial institutions to promote financial education as a way of reducing default and strengthening customer relations.

Under the new rules, banks and other institutions must offer accessible initiatives to help Brazilians make more conscious decisions about their money, from tips on organizing the budget and creating a reserve, to guidance on the responsible use of credit and financial planning.

“Although the resolution is going in the right direction, we believe that banks can, and should, go further,” says Enrique. “This is a unique opportunity for them to stop being just service providers and start acting in a more transformative way, what we call ‘Deep Banking’.”

A recent survey showed that the biggest concern for Brazilians today is being able to support themselves financially and pay off debts. The problem not only affects the pocket, but also physical and mental well-being. Among those interviewed with outstanding debts, 82% reported negative impacts on their mental or physical health due to financial stress.

“Being in debt can be a lonely experience,” says Enrique. “But what if the bank not only helped those in debt, but also acted to prevent them from getting to that point?” For him, this is the chance for banks to act as financial advisors, taking advantage of the data and habits they already know about their customers.

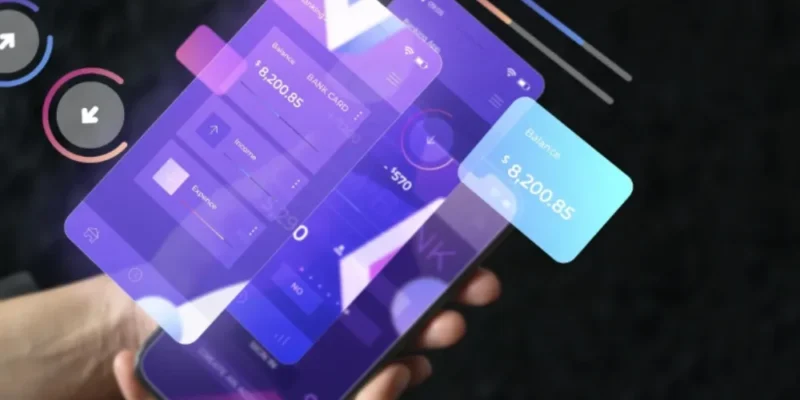

In Brazil, 7 out of 10 financial transactions are made by cell phone, and the expectation for ‘hyper-personalization’ is growing among Latin American consumers: 53% want personalized banking offers and 62% expect companies to anticipate their needs.

“We are already in the palm of our customers” hands and, with the use of data and artificial intelligence, we are able to offer a more intelligent and personalized service," says Enrique.

In this context, Moneythor recently launched the Empower platform for financial well-being in Latin America. The solution offers banks tools to help their customers better control their spending, save more efficiently and deal with debt, through personalized tips, budgeting guidelines and gamified incentives that encourage healthy financial habits.

“It's not just consumers who benefit, but banks too,” concludes Enrique. “Empower helps to create a closer, more intuitive and continuously supportive experience. These tools transform the role of banks, which are no longer just service providers but reliable partners, strengthening customer relationships and setting a new standard for financial inclusion in Latin America.”