Effective July 9, the new positive registry could include up to 22 million consumers in Brazil's credit market.

The economic and social benefits of the initiative will impact all regions of the country

June 10, 2019: Sanctioned by the President of the Republic, Jair Bolsonaro, in April, the new Positive data comes into force on July 9th. Now with automatic inclusion of consumers, as is already the case in more than 70 countries, the CP will allow Brazilians to be assessed individually and more thoroughly by creditor companies, reducing the bureaucracy of consultations and facilitating access to credit. The population will thus be able to negotiate better rates and conditions, which should have an impact on financial planning and, consequently, reduce defaults in the country. Based on a study carried out by the sector, the ANBC (National Association of Credit Bureaus) estimates that the new format of the Positive Registry has the potential to include up to 22 million people in the national credit market, as well as injecting more than R$ 1 trillion into the economy.

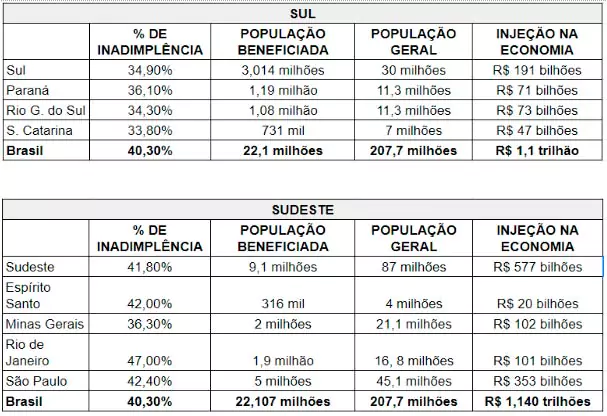

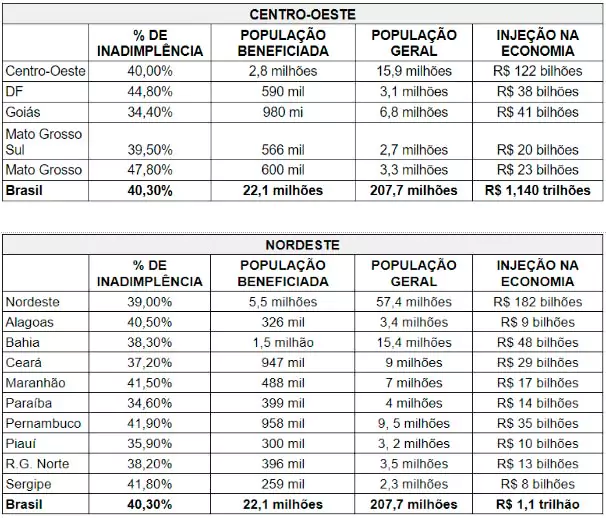

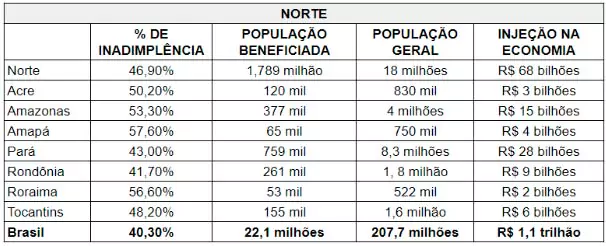

According to the survey, the North is the region with the highest default rate in relation to the population (46.9%). Also in the region, Amapá and Roraima, with 57.6% and 56.6% respectively, are the states with the most defaulters in the country. At the other end of the spectrum, the southern region, with 34.9%, has the lowest default rate. And Santa Catarina, with 33.8% of defaulters, is the state with the lowest rate, well below the national average of 40.3%.

Regardless of location, the new Positive Registry tends to promote a reduction of up to 45% in defaults, according to an industry study. Generally speaking, the increase in credit available to consumers is around 10% of each state's population. Mato Grosso do Sul stands out in this regard. According to the survey, the state, which has a total population of 2.7 million inhabitants, is expected to add around 570,000 people or more than 20% of the total to the credit market with the new register. Currently, these people do not have access to credit because they have low credit scores due to a lack of information about them, and not because they are defaulters.

“The inclusion of more people and the expansion of credit for those already in the market, provided by the new Positive Registry model, have the potential to lower interest rates on loans and financing,” observes Elias Sfeir, president of ANBC - Associação Nacional dos Bureaus de Crédito (National Association of Credit Bureaus). “And lower interest rates allow more credit to be taken out without jeopardizing the consumer's ability to pay,” he adds.

Summary of the main benefits

- More accessible and cheaper credit through credit scoring

Reducing the risks involved in offering credit makes for lower interest rates and greater competition in the credit market. Empowering borrowers - whether they are consumers, SMEs or entrepreneurs - through credit scoring could reduce defaults by up to 45%. The law will make it possible to include 22 million people in the credit market, and even those without proof of income will be able to access credit thanks to their CP.

- Increase in employment due to economic boom

This instrument can increase annual GDP by 0.54% p.a. and can inject up to R$ 1.1 trillion into the economy in the medium term, and a heated economy creates jobs and increases citizens' incomes.

- Fairer credit assessment based on scores

CP reverses the scenario of credit decisions based on negative parameters. Positive credit history becomes more relevant. Citizens with a good track record but who have been in default will also be assessed on the basis of accounts paid on time.

- Improving credit for the less privileged classes

Consumers in the worst score bands and who, for the most part, have lower incomes, stand to gain the most from the CP. A study carried out by the sector estimates that 60% of the least advantaged would see an increase in their score with the new CP.

- Consumer control over their information

The law complies with the requirements of the Consumer Protection Code, as the cancellation of a registration can be done at any time. Under the current system (voluntary membership), credit history data such as bill payments and loans is open to all consultants (stores, banks, financial institutions, utility companies, etc.). With the new law, this data is automatically included in the credit score and the opening of data is done by the borrower with the consultant.

- Privacy guarantee

The credit score will be made up of data relating to loans, financing, credit, water, electricity, gas and telephone bills. Information relating to health, travel or social interactions will not and cannot (by law) be used.

ANBC Press Relations

Regina Pimenta: (11) 98136.6835 regina@pimenta.com

Ana Carolina Rodrigues: (11) 98674.0348 anacarolina@pimenta.com