Brazil is a country of continental dimensions and therefore has very different social and economic realities. Over the last few years, for example, the Midwest region has seen extraordinary growth, driven by the agricultural sector. The performance of economic activity is one of the factors conditioning the credit market, as well as other structural factors, such as the level of visibility of the local population. This article presents data on the evolution of credit in the country's five regions and on the availability of information that is essential for credit decisions by financial institutions.

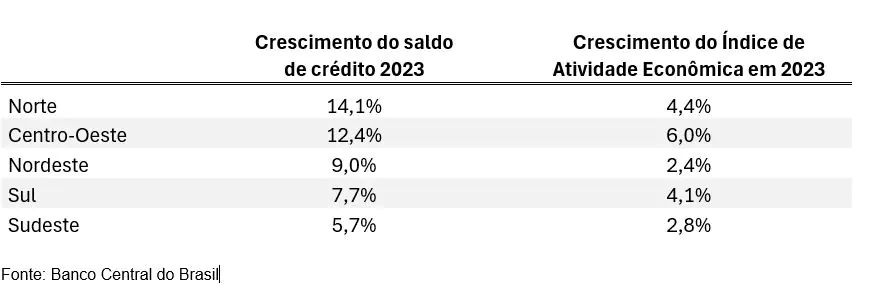

According to data from the Central Bank, in the country as a whole, the credit balance grew by 8% in 2023. Breaking this data down by region shows that the biggest growth was recorded in the North, with a 14.1% increase in the total credit balance. This was followed by the Midwest, with a 12.4% increase in the credit balance. The states in these two regions have seen significant economic activity, driven by agricultural production.

The table below shows the growth of the credit balance and the Central Bank's Regional Economic Activity Index, since the official GDP data, calculated by the IBGE, is released with a longer lag.

The greater the economic growth, the greater tends to be the demand for resources on the part of companies to make investments and business improvements. Similarly, the greater the growth, the more jobs, the better the distribution of income and the greater the demand from families for goods and services - a demand that will, in part, be financed through credit operations.

However, it is the structural factors that can guarantee sustainable credit growth, boosting the economic development of the regions. In addition to the economic situation, local specificities also play a role: it can be seen, for example, that cooperative credit is more important in the South of the country. These factors also include the level of formalization of the economy, the availability of credit information and the population's knowledge of the use of this instrument.

Data from the credit bureau sector shows that in all states information from the Cadastro Positivo covers a high percentage of the population, but there is still significant variability. On the national average, 84% of the population aged between 18 and 70 has information available in the CP, with percentages varying from 66% to 96%, depending on the state. In this regard, the credit bureau sector, represented by the National Association of Credit Bureaus (ANBC), has held a series of meetings with local entities and authorities in different states to expand the scope of the information that makes up the Positive Registry with the integration of the sanitation sector into the program. The bureau sector estimates that, in the country as a whole, 50 million records could be added with the entry of these companies. The aim of this agenda is to increase the percentage of individuals with visibility for credit, especially in places where there is low banking and formalization of the economy.

An increasingly digitalized financial life also requires infrastructure to facilitate internet access, as well as financial and digital education. In short, the national agenda for modernizing the credit market in Brazil can be promoted at a local level, boosting the economies of states and municipalities by expanding access to resources for companies seeking investment and consumers looking to anticipate a consumer dream.

Regional credit

Thanks for reading! Access other content at ANBC website.

President of ANBC - National Association of Credit Bureaus. Representative of Latin America in the World Bank Credit Committee. He also represents Brazil and Latin America in credit organisations accross the world, such as ACCIS, BIIA and ALACRED.