In our last article, we reflected on the importance of financial education in schools and highlighted the fact that this subject should also have a place outside of schools, including the family environment and even in companies. After all, financial problems can have an impact on social well-being and even productivity at work. Around the world, various initiatives have emerged in recent years to engage with the issue, uniting public and private entities in an effort to raise awareness.

In 2020, the Brazilian Federation of Banks (FEBRABAN) launched the Brazilian Financial Health Index (I-SFB). The credit bureau sector was invited as one of the members of the technical group developing the platform and reviewing the new index. The I-SFB was built on the basis of international protocols, such as the “Financial Well Being Scale”, and the Consumer Protection Financial Bureau (CFPB), among others.

Based on these experiences, rounds of research and studies sought to adapt the international protocols to the Brazilian reality. The resulting model analyzes five dimensions of financial life: the freedom, which measures whether the way an individual handles money allows them to have options in life; the security, which assesses whether financial life is a source of stress and worry; the skill, which measures the ability to understand important information for one's financial life; the behavior, which evaluates the individual's discipline and control; and the proficiency, This is understood as a combination of skill and behavior.

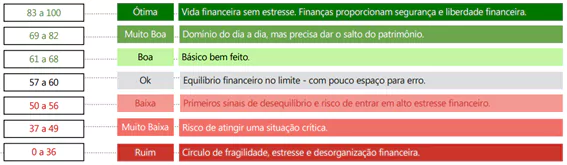

Each dimension is assessed using three questions. The answers generate a score and the result ranges from zero to 100. The closer the score is to 100, the greater the individual's financial health. Depending on the score, individuals are also classified into different categories. At the level considered “Good”, the assessment is that the individual has a life without financial stress and the finances provide security and freedom; at the level considered “OK”, the finances are balanced, but on the edge, with room for error. At the other end of the spectrum, at the “Bad” level, there is great financial fragility, stress and disorganization.

Financial health bands

In the 2023 survey, the average Brazilian score was 56.2, which would place the “average” Brazilian at the “poor financial health” level. In this classification, there are the first signs of imbalance and the risk of financial stress. Among the main results were the fact that 50% said they were experiencing some kind of financial squeeze; 74% said they were earning more or less and 68% said they were unsure about their financial future.

Compared to the 2022 result of 56.0 points, the financial health of Brazilians has practically stagnated. Despite the improvement in the economic indicators of income and employment, there was still a persistence of indebtedness, which only showed a slight decline in the second half of the year. The construction of a historical series will allow us to monitor the impact of financial education actions on the financial health of Brazilians, enriching the analysis of economic data on income and employment.

In addition to the macro objective of allowing an aggregate assessment of Brazilians, the tool also plays the role of guiding individuals. Anyone can diagnose their own financial health on the Index website, allowing them to identify any financial vulnerabilities. The initiative is in addition to the credit bureaus' efforts to make individual consultations available online, completing the financial diagnosis stage. These consultations make it possible to identify debts in arrears and facilitate the process of renegotiating debts, as well as offering another score based on credit history - the credit score.

It is true that behavioral changes, such as those sought through the dissemination of financial education, take time to mature. However, they will be essential to ensure that the use of credit provides the desired well-being.

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor