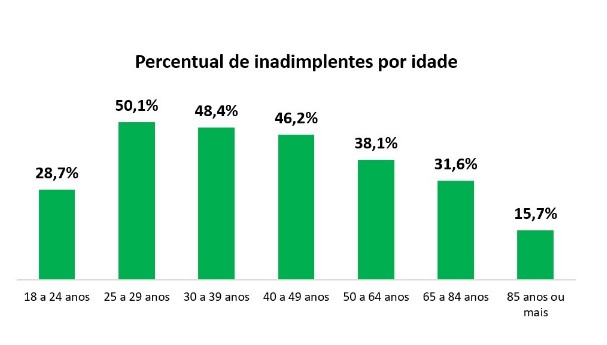

Achieving financial independence is a common desire among young people. But how many are actually prepared for the responsibilities of adult life? Young people finishing college or starting their careers often find themselves surrounded by financial commitments for which they have yet to be prepared. To give you an idea of the challenge, data released by the National Confederation of Shopkeepers (CNDL) shows that the number of defaulters in the 25-29 age group reached 8.62 million in February 2024. This figure represents no less than half (50.1%) of the population in this age group. In the 18 to 24 age group, 28.7% are in default.

This is far from a good start. The reality of high unemployment among young people certainly contributes to this picture of high defaults, but we also need to consider behavioral factors, such as impulsive buying and the lack of basic notions about how to handle money.

So what can be done to make this phase more comfortable for the younger generations? The solution is to spread financial education and raise awareness about the use of credit.

Practically all over the world, experts and financial educators are unanimous in pointing out the importance of learning to deal with money from an early age. In recent years, it is true that this topic has gained ground on social networks and in traditional media, and has been encouraged by public and private entities. The figures show that this work needs to be stepped up, including reinforcing school curricula with finance-related topics. But although the younger generations are more connected and have access to more information, the number of young people with full access to financial education is insufficient. There are many people in the country who still have difficulty dealing with basic financial issues, such as managing their personal or family budget, investing and participating in the credit market.

It is essential to disseminate the tools necessary for young people to understand the value of money, make more responsible choices and take control of their future. Knowing more about budgeting, controlling expenses, credit, investments and the time value of money can make all the difference to young people making intelligent decisions throughout their lives and paving the way to ensure their financial health.

Paving the way for financial inclusion

Learning to control spending, knowing the value of money and investing according to risk profile are just a few examples of the advantages that good financial education brings to young people. How do you motivate them to take an interest in all these direct benefits? For many, financial education probably sounds like an uninteresting, distant activity that they can do without.

So what's the solution?

We've identified ten steps that can make a difference:

1) Start early: financial education should start early. It's important for parents to make it clear that budgeting often leads to the need to make choices and establish priorities and, whenever possible, to invite their children to take part in the decision. It's up to the school to introduce the first concepts of financial life. The presence of financial education in school curricula is planned as a cross-curricular theme, addressed in other subjects. Another important initiative is the Learning Value program, launched by the Central Bank of Brazil in 2021. According to the most recent data from the Central Bank, 22,000 public elementary schools participate in the program, which covers 53% of the country's municipalities in all states.

2) Make learning fun and engaging: the key to getting young people involved in financial education is to make it fun and engaging. As well as starting early, it's important to use resources that are familiar to young people, such as gamification and interactive activities. Classic games - such as Monopoly - are good options. Older people tend to be more analog than digital. Young people, on the other hand, are generally more comfortable with technology.

3) Use real-life examples: for young people, it's great to see how financial education relates to their real lives. When they talk openly about their household budget, everyday bills, credit card use and investment precautions, it makes financial education more tangible and less dry.

4) Financial incentive: the good old pocket money is recognized as an effective way of motivating young people to learn about personal finance and gain a certain amount of independence. Offering financial rewards for helping with day-to-day tasks instills in young people a sense of responsibility and shows them, from an early age, that achieving something requires some kind of effort. Encouraging them to read financial texts and take part in online courses - and offering rewards for learning - is also an excellent stimulus for increasing their interest in finance.

5) Role models: parents, teachers, friends and adult family members who have a good track record of responsible financial behavior can and should serve as role models for young people to make them more likely to get involved in financial education.

6) Saving, investing and setting long-term goals: teaching the value of money over time and showing how the magic of compound interest works is one of the best ways to motivate young people to save money and invest. Recognizing the need to start building up a financial reserve from an early age is fundamental. It's proven: future goals and objectives are much easier to achieve when you start saving early.

7) Financial spreadsheets: recording income and expenses in a spreadsheet is a healthy practice for controlling the budget. Small monthly expenses should also be paid attention to and, when calculated on an annual basis, they light up the red light - making the decision to cut them easier.

8) Investments: talking about different investment options is important to get young people interested in more complex financial matters. It is essential to know the risks and benefits associated with each type of investment, which investor profile the young person fits into and the expected return for each asset class.

9) Credit operations: to complete a good financial education, young people must know about credit. Debts taken out consciously can be of great help to those who want to achieve their goals more quickly. Educational loans help make personal and professional development possible. Use the overdraft limit? Only in an emergency, never for consumption. Credit cards make life easier, but when the bill arrives, it's essential to pay it in full and on time.

10) Make a habit of keeping track of your credit score. Young people starting out in their banking and credit relationships have an important incentive to make payments on time: the operation of the Positive Registry, which sheds light on honored commitments, values credit history in the analysis for granting loans and financing and popularizes the concept of the credit score. Benefiting from greater familiarity with digital channels, young people also have endless possibilities for online learning, including the initiatives of credit bureaus.

Conclusion

Acquiring more knowledge about finance undoubtedly helps young people to develop greater maturity in money-related matters and to better navigate the more sophisticated and complex financial services that are expanding in the country. Building up a good payment history from an early age and using credit cautiously help to inhibit financial lack of control and the bad habit of falling into arrears, thereby increasing young people's access to better credit conditions. And when it comes to investments, incorporating the habit of saving to achieve financial freedom into your lifestyle will make all the difference in the future.

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor