Data from the Central Bank of Brazil show that the balance of loans to Legal Entities grew by 8.9% in the comparison between October 2024 and the same month in 2023

The National Association of Credit Bureaus (ANBC) believes that, in 2024, the credit sector played a fundamental role in Brazil's economy. Credit was consolidated as one of the economic engines, reflecting the recovery of various sectors.

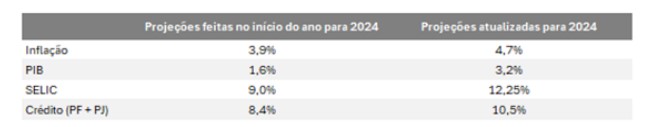

Data from the Central Bank of Brazil show that the balance of loans to Legal Entities grew by 8.9% in the comparison between October 2024 and the same month in 2023. In the segment of loans to Individuals, the credit balance grew by 12.0% on the same basis of comparison, maintaining a high rate of advance. With these results, the credit-to-GDP ratio reached 54.5% in October 2024, compared to 52.6% in October 2023. The table below shows the projections made at the start of the year and the latest projections for 2024.

“The favorable credit cycle reflects the conjunctural conditions and the various structural transformations taking place in this market. In 2024, the credit bureau sector celebrated five years of the Positive Registry, with evidence of impacts on credit such as visibility for credit for 21.3M individuals and companies, greater precision in analysis and improvement in the credit rating for the majority of individuals, consolidating it as a consumer right. This milestone was an opportunity for us to debate the contribution of the various sectors of the economy to financial inclusion through the sharing of positive data,” says Elias Sfeir, executive president of ANBC.

Other measures to modernize the credit market are still maturing, such as the guarantees framework, approved in 2023. The expansion of the scope of credit information and, in the event of default, easier access to the operation's guarantees contribute to reducing risks, making it possible to expand credit more safely.

Commitment to the future

According to Sfeir, for 2025 the credit bureau sector is renewing its commitment to financial inclusion through visibility for credit and to accurate risk and fraud analysis, including solutions that embrace the climate dimension, through its services, educational actions and active participation in discussions about the future of the Brazilian and international credit market. “In addition to cyclical fluctuations, which will continue to be monitored, we will continue to look at structural measures, with medium- to long-term effects,” he concludes.