Credit growth goes hand in hand with delinquency challenges

The Southeast maintains a consistent pace of credit growth, according to Central Bank data for June 2025, with an expansion of 12.7% for individuals and 9.1% for companies compared to the same period last year. For comparison purposes, the national average was 11.9% (individuals) and 8.8% (companies).

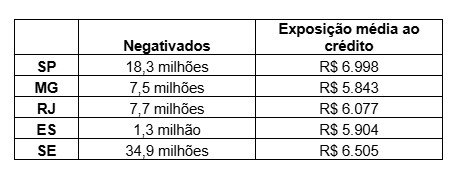

Among the states, São Paulo recorded growth of 12.91 T3T in loans to families and 10.61 T3T in loans to companies. Minas Gerais saw an increase of 14.1% (PF) and 9.2% (PJ). In Espírito Santo, the increase was 16.0% (PF) and 9.1% (PJ), while Rio de Janeiro showed a rise of 9.4% (PF) and 4.0% (PJ).

According to data from the credit bureau sector, delinquency continues to be a cause for concern. In June 2025, 51.41% of the population of São Paulo was in default, compared to 44.51% in Minas Gerais, 41.61% in Espírito Santo and 57.21% in Rio de Janeiro. Among companies, 38.61 % of the population in São Paulo, 28.01 % of the population in Minas Gerais, 24.71 % of the population in Espírito Santo and 35.71 % of the population in Rio de Janeiro had credit restrictions.

The table below, based on data from the credit bureau sector, shows the distribution of total debt in the Southeast:

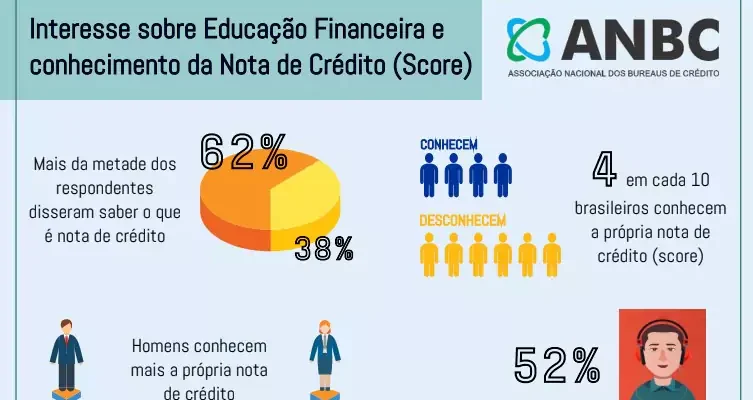

“The credit market in the Southeast is growing at a significant rate, with all the states participating, but defaults are still a major challenge. It is essential to combine access to credit with financial education and responsible lending to ensure the system's sustainability,” says Elias Sfeir, president of the Association of Credit Bureaus (ANBC).

The scenario for the Southeast in 2025 illustrates the dilemmas facing the credit market: stimulating consumption and investment, while at the same time seeking greater balance in the finances of the families and companies that move the region.

Read also:

Entry in the positive register reduces interest by 8.7%, shows BC study