Class C is the most in control of its accounts and knows what a credit rating is, says study

The information is contained in a survey carried out by the National Association of Credit Bureaus (ANBC)

São Paulo, August 25, 2021: Class C consumers, according to family income, are the most likely to keep track of their budgets (85%), compared to 81% for those in classes AB and 75% for those in classes DE.

This information, which is contained in a survey carried out by National Association of Credit Bureaus (ANBC), reveal that in about two years of using the Positive data, According to the survey, class C consumers are also the ones who know the most about credit scores, with 73%, compared to 67% from classes AB. Respondents belonging to the DE classes, with 54%, are the least knowledgeable about credit scores.

However, when asked if they know and follow their credit rating in order to know if they will have access to credit, this scenario changes. On this item, 391,000,000 respondents from classes AB said they follow the evolution of the credit rating for this purpose, compared to 381,000,000 respondents from classes DE and 361,000,000 respondents from class C.

To gather information by region of the country, the survey grouped respondents into two blocks: the south and southeast regions, with 78% of respondents, and the north, northeast and center-west regions, with 22% of respondents.

A comparison between the regions shows a balance of responses. Thus, in the north, northeast and central-west, 85% of those surveyed said they sought information on financial control, while in the south and southeast there were 86%.

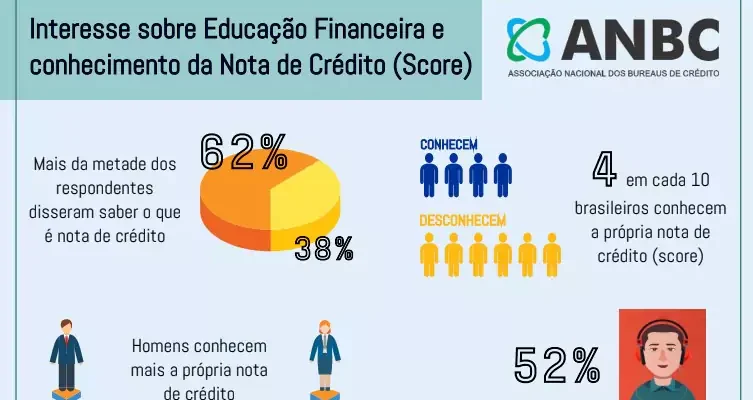

In the five regions, the rate of those who know what it is credit note is 62%. And no less than 56% of those surveyed in the north, northeast and central-west regions, and 57% of those interviewed in the south and southeast regions consider the credit score to be very important for their financial life.

For Elias Sfeir, president of ANBC, “the survey shows that Brazilians are seeking more information and financial education. The fact that, in all regions of the country, 2 out of 3 interviewees know what a credit rating is, indicates a promising path”. Sfeir emphasizes: “in addition to financial education, it's essential that a financial attitude is also part of Brazilians” daily lives - after all, having the knowledge and not applying it is ineffective.".

ANBC has generated an infographic with the highlights of the Survey. Read more

ANBC Press Relations

Regina Pimenta: (11) 98136.6835 regina@pimenta.com

Ana Carolina Rodrigues: (11) 98674.0348 anacarolina@pimenta.com