Data on the performance of the credit market in 2021 was recently released by the Central Bank of Brazil. As expected, the total balance of loans and financing made by the National Financial System advanced in 2021, but the pace of growth was slower than that recorded in 2020.

Looking at the details, last year's data confirms a trend observed in the credit market since the middle of the last decade: an increase in the share of the individual segment in the distribution of credit. credit. This trend was quickly interrupted in 2020, when there was a focused effort to provide companies with resources to avoid going out of business, but it was evident once again in the 2021 figures.

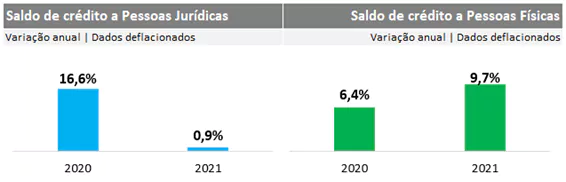

According to the Central Bank, the growth in the balance of credit to legal entities advanced, in nominal terms, by 11.1% in 2021, while the balance of credit to individuals grew by 20.8%. Deflating these figures, we note that the growth in credit to companies was practically nil in 2021 (0.9%), while the advance in credit to individuals was close to double digits in real terms (9.7%). The graph below summarizes the real growth in credit in 2020 and 2021, for both individuals and companies.

The same upward trend in consumer credit was reported by other central banks. With data up to November 2021, the FED releases figures which show greater growth in credit for families, especially credit cards. In the USA, the advance was 11%, with revolving credit cards advancing 23.4%.

The strong growth in corporate credit seen in 2020, the first year of the pandemic, was driven by government and private credit stimulus measures. In 2021, measures to stimulate business credit were reduced as the economy recovered and restrictions were lifted.

Considering only the credit destined for companies, there is an important fact: the participation of the MSEs in the share of loans and financing had been falling for almost a decade, but since the beginning of the pandemic, this trend has been reversed: in 2021, the growth of credit to small businesses was 6.7%; while the balance of credit to large companies fell by 3%.

Access to credit for small businesses was a concern even before the pandemic. With economic activity at a standstill, there was a fear that the lack of resources would jeopardize the survival of small businesses. The figures show that the measures taken to ensure that resources reach these companies have worked to some extent.

In the segment of credit to individuals, the modalities that grew the most in 2021 were revolving credit and financing for the acquisition of goods. After ending 2020 at minimum levels, default rates showed a slight increase, but remained well below the values observed before the pandemic. According to the Central Bank's figures, the default rate, i.e. the percentage of the credit balance in arrears for more than 90 days, ended 2021 at 2.3% - at the end of 2020, this rate was 2.1%.

This year marks a new moment. The performance of the credit market will be determined by situational and structural factors. In the conjuncture, we are faced with a higher basic interest rate, in an effort to combat inflation, and the prospect of low growth, at least for the time being - in other words, an unfavorable scenario for the advance of credit. In structural terms, however, we are witnessing the maturing of a series of measures that should make the credit market more efficient, and which we have commented on in this space. Efforts are being made to increase competition in the credit market, improve the guarantee and information systems for granting credit.

Measured as a proportion of GDP, the total balance of loans e financing ended 2021 at 54%. In absolute terms, this balance reached 4.68 trillion reais. We can say that the credit market has played its part in these years of crisis, cushioning the impacts of the pandemic on the lives of families and the functioning of companies. Credit bureaus helped write this story, providing fundamental information for decision making by credit grantors, helping to preserve the stability of the financial system and contributing to increasing the well-being of Brazilians.

Credit performance

Thanks for reading! Access other content at ANBC website.

President of ANBC - National Association of Credit Bureaus. Representative of Latin America in the World Bank Credit Committee. He also represents Brazil and Latin America in credit organisations accross the world, such as ACCIS, BIIA and ALACRED.