Taking stock of 2024: credit expansion, rising interest rates and the climate issue

We have reached the final stretch of 2024. Throughout the year, we've covered the transformations in the credit market in this space, and we've kept up with the economic changes affecting this market. The year has held some surprises, reinforced trends and pointed out challenges. This is a good time to take stock.

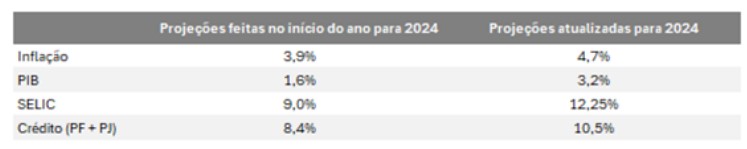

At the beginning of the year, there was the prospect that inflation would follow a more favorable path, without major damage to economic activity and employment. This was the “soft landing” hypothesis used by the International Monetary Fund (IMF) to describe the global economic scenario at the start of the year. What we saw, however, was more persistent inflation, leading to the postponement of the interest rate cut in the US economy - the cut did not actually take place until September 2024.

In Brazil, the second half of the year was marked by a rise in interest rates, something that was off the market's radar at the start of the year. The change in interest rates reflects the high projections for inflation. The SELIC rate hike cycle was the main change in the scenario and, as it has a delayed effect on the economy, it could have implications for the trajectory of credit next year.

If, on the one hand, inflation has persisted, on the other hand, economic activity has surprised. Projections for GDP growth in 2024 were revised upwards throughout the year. According to the Focus Bulletin, The Brazilian economy is expected to grow by 3.2%. At the start of the year, the Bulletin's projections pointed to growth of 1.6%. As a result of the higher than expected growth, unemployment has fallen, while average income has risen. Even with the favorable evolution of income, the percentage of people who have been denied credit remains high, at around 45% of the adult population, according to data from the credit bureaus setot.

Credit was one of the driving forces behind the economy - in this case, as predicted at the start of the year. The forecasts at the start of the year suggested a recovery in business credit, which had slowed down over the course of 2023. And that's what was actually observed. Data from the Central Bank of Brazil show that the balance of loans to Legal Entities grew by 8.9% in the comparison between October 2024 and the same month in 2023. In the segment of loans to Individuals, the credit balance grew by 12.0% on the same basis of comparison, maintaining a high rate of advance. With these results, the credit-to-GDP ratio reached 54.5% in October 2024, compared to 52.6% in October 2023. The table below shows the projections made at the start of the year and the latest projections for 2024.

The favorable credit cycle reflects cyclical conditions and the various structural transformations taking place in this market. In 2024, the credit bureau sector celebrated five years of the Positive Registry, with evidence of impacts on credit such as visibility for credit for 21.3M individuals and companies, greater precision in analysis and improvement in the credit rating for the majority of individuals, consolidating it as a consumer right. This milestone was an opportunity to debate the contribution of the various sectors of the economy to financial inclusion by sharing positive data.

Other measures to modernize the credit market are still maturing, such as the guarantees framework, approved in 2023. The expansion of the scope of credit information and, in the event of default, easier access to the operation's guarantees contribute to reducing risks, making it possible to expand credit more safely.

Throughout the year, extreme weather events have affected Brazil and the world. This issue is related to the financial system because the credit and capital markets choose which business projects, with greater or lesser environmental impact, to finance. The growing trend is for environmental criteria - in addition to social and governance criteria - to be included in the risk account, creating an incentive for sustainable practices to be adopted.

Some of the key issues will run through 2024 and remain on the agenda in 2025. This is the case with the climate debate, the high level of defaults and persistent inflation. Projections show that further increases in the basic interest rate are likely ahead. In this sense, commitment to the spending targets established by the fiscal framework will be crucial for slowing inflation and limiting the current cycle of interest rate hikes.

For 2025, the credit bureau sector is renewing its commitment to financial inclusion through visibility for credit and to accurate risk and fraud analysis, including solutions that embrace the climate dimension, through its services, educational activities and active participation in discussions about the future of the Brazilian and international credit markets. In addition to cyclical fluctuations, which will continue to be monitored, we will continue to look at structural measures, with medium to long-term effects.

Happy holidays and see you soon!

Thanks for reading! Access other content at ANBC website.