In our last article, we took stock of 2025, highlighting the slowdown in economic activity, in line with projections at the start of the year, the rise in the basic interest rate and the growth in credit. The aim now is to look ahead: what can we expect in 2026?

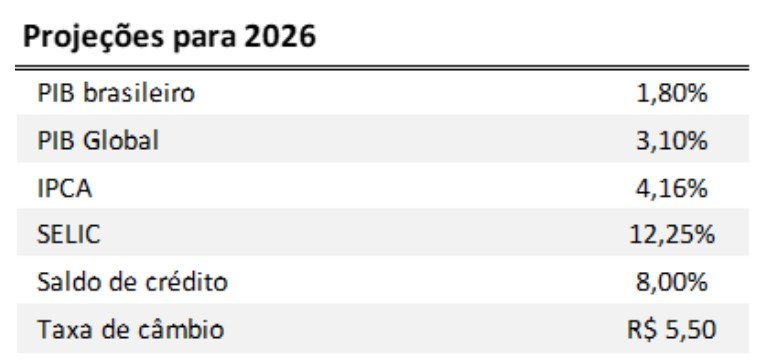

Let's start with economic activity. For 2026, GDP is forecast to grow by 1.8%, according to the Focus Bulletin. This advance, if confirmed, would represent a slowdown in growth compared to recent years, including 2025. For comparison, the growth projections for the global economy, published by the International Monetary Fund (IMF), The figures show growth of 3.1%, higher than forecast for Brazil.

Another factor to note is the major geopolitical events (especially conflicts) tend to increase sovereign premiums, with a stronger effect on emerging markets and possibly reaching banks and the supply of credit via the balance sheet and the cost of funding

These projections carry some uncertainty, especially considering that election years historically tend to bring greater volatility to the market. However, these figures help to identify the points of attention for next year and serve as a starting point for planning and setting goals.

The economic slowdown projected for 2026 and already seen in the data for the 3rd quarter of 2025 reflects the upward cycle of the basic interest rate, which reached 15.0% per year. The increase in the SELIC rate is already showing some results in the fight against inflation. According to the Focus Bulletin, the IPCA should end 2026 with a variation of 4.16%. This result would still be above the center of the target, but below the ceiling.

The cooling of inflation in recent months was highlighted in the communiqué of December 10 in which COPOM announced its decision to maintain the SELIC rate at 15.0%. However, the committee stressed its commitment to bringing inflation back to the center of the target by keeping interest rates at the current level for a “prolonged period”.

What do the market forecasts for interest rates actually show? According to the Focus Bulletin, the SELIC rate is expected to fall next year, reaching 12.25% in December 2026. The exact start of the rate cut cycle is what still divides opinion. On the same day that COPOM set the SELIC rate, the Federal Reserve (FED) chose to reduce the interest rate by 25 basis points. As next steps, the monetary authority suggested caution in the face of the still uncertain effects of US tariff policy on inflation and, consequently, the next steps of the FED.

In the Brazilian credit market, 2026 should show the impact of recently introduced changes. Projections for credit growth in the country indicate that the balance of loans and financing operations should grow by 8.0% in 2026, according to the Monetary Policy Report , by the Central Bank. In the Individuals segment, the advance should reach 8.3%, compared to 7.4% in the corporate segment. If confirmed, this variation should represent a slowdown in relation to the rate of growth of recent years, although it still remains significant.

Three modalities will deserve attention in the coming year: the new real estate credit, private payroll loans and, with the introduction of book-entry duplicatas, operations to anticipate receivables. In this space, we comment on the changes planned for real estate loans and the expected impact on the supply of credit. Estimates indicate an immediate injection of around R$ 36.9 billion into real estate credit, according to BC figures. It will also be important to evaluate the impact of this modality on the commitment of family income.

The bureau sector will keep a close eye on the impact of these measures on the Brazilian market, since the data, translated into relevant information for decision-making, can guide credit growth in the country in a sustainable direction, capable of mitigating the risk of default, protecting consumers and companies from fraud and giving visibility to those who still operate on the margins of the financial system.

As we pointed out in the previous article, over the course of the year, the data released by the credit bureau sector showed an increase in the percentage of adults who have been denied credit. In absolute numbers, denials reached a record high. For 2026, the evolution of delinquency and indebtedness rates will depend on cyclical developments, especially in the labor market. The lower unemployment rate captured in the latest IBGE measurements, if maintained, could favor a drop in indebtedness. This will be one of the main challenges inherited from 2025 and should guide companies' credit recovery strategies, as well as strengthening credit analysis processes.

In 2026, measures to strengthen the Brazilian credit market will continue. The credit bureau sector's actions will continue to be guided by the principles of data protection, innovation and financial inclusion, creating the conditions for credit to be sustainable and contribute to increasing the well-being of families and the growth of companies and the economy. We wish our readers a great new cycle!

Thanks for reading! Access other content at ANBC website.