ANBC has become a member of BIIA, an organization active in information services and credit agencies in the Middle East, Asia and the Pacific.

Entities join forces to promote good global practices, including innovations in the Brazilian market

The National Association of Credit Agencies (ANBC) is now a member of the Business Information Industry Association (BIIA), an organization that represents companies involved in information services and credit agency ecosystems operating mainly in Asia-Pacific and the Middle East. This collaboration provides a unique space for exchanging experiences and building joint solutions for emerging and developed markets.

The dialog between ANBC and BIIA aims to align the visibility of credit in Latin America with global best practices. For Elias Sfeir, president of ANBC, the association strengthens the sector, boosting sustainable development through the exchange of knowledge on regulation, innovation and the use of data. "ANBC acts as a driving force for innovation and governance in the credit sector in Brazil and Latin America and this initiative will further expand our action. We are recognized as the voice of innovation and sustainability in credit and our mission is to promote a fairer, more efficient and inclusive credit ecosystem, bringing benefits to all those involved", says Sfeir.

Neil Munroe, Managing Director of BIIA and Vice President of ICCR commented on the incorporation of ANBC into BIIA: "It's great to be able to welcome ANBC to the BIIA community. With Latin American organizations taking a growing interest in the Middle East and Asia Pacific and with BIIA's current members taking an active interest in building relationships in the region, ANBC's joining is very timely. We look forward to supporting ANBC in its important objectives and its contribution to BIIA's work".

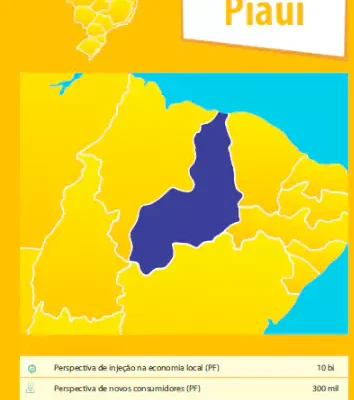

In addition to its recent collaboration with BIIA, ANBC already maintains strategic partnerships with other important international organizations, such as ACCIS (European Association of Credit Information Services), ALACRED (Latin American Credit Federation) and ICCR (International Credit Reporting Committee), reinforcing its commitment to modernizing and strengthening the global credit ecosystem. Among its main achievements are the implementation of the Positive Credit Register Program, which has already made credit visible to 21 million individuals and companies, the Central Bank of Brazil's SCR, which has added 6 million more unpublished records, the constant search for new sources of data, the promotion of credit, one of the engines of the economy and social welfare.

Initiatives such as studies, content for financial education and regulatory participation, coordinated by ANBC, will have global visibility.

Read also:

Despite Trump, sustainability remains a determining factor for credit