More on credit and financial education for SMEs - part 2

In our last article, we explored the importance of financial education for small businesses. One of the pillars highlighted was credit. These companies act at one end as potential borrowers and at the other as lenders. In this article, we seek to measure the size of the credit market for this segment, as well as the importance of this instrument for the growth of companies and, consequently, the economy.

In Brazil, where the use of own resources to make investments and to run businesses still prevails, micro and small companies could be one of the vectors for expanding the credit-GDP ratio. According to data from the Central Bank of Brazil (BCB), in the 2nd quarter of 2023, the number of micro and small business borrowers in Brazil was around 6.7 million, out of a universe of around 22 million companies or 30.4%. For comparison, data collected by the Federal Reserve Bank (FED) shows that, in the United States, the proportion of small businesses that make regular use of credit instruments - cards or loans - is higher than that of small businesses. reached 87% by 2023, covering almost all of these companies.

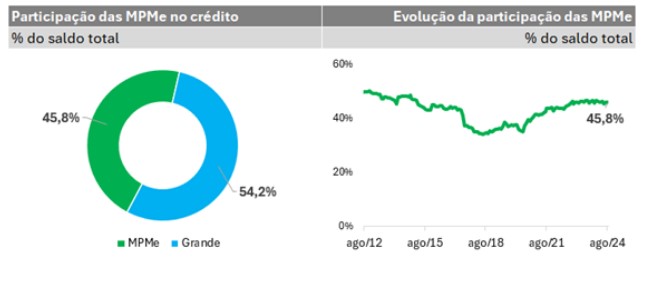

Also according to the BCB, in terms of participation in the total credit balance, the outstanding amount - overdue or to be overdue - of operations carried out by micro, small and medium-sized enterprises (MSMEs) was estimated at 45.8% of the total amount allocated to legal entities in August 2024. In absolute terms, this amount reached R$ 1.08 trillion in August 2024, which represents around 9.5% of GDP.

The evolution of these figures over the last few years shows that at the beginning of the historical series, in 2012, the division of credit between large companies and MSMEs was practically half and half. With the onset of the crisis in 2014, the share of small businesses in the credit pie began to fall, recovering with the onset of the pandemic. Even with the recovery, the percentage is still below 50%.

The BCB data also shows that the default rate is higher in the MSME segment than in the large company segment. The difference is significant: 4.5% compared to 0.2%. One of the explanations for this difference is that, in general, large companies have fundraising departments, unlike smaller companies, which work with reduced structures. This is reflected in the choice of credit contracted and, consequently, in the company's solvency capacity.

Hence the importance of financial education, discussed in the previous article. Interest rates on operations vary considerably, depending on the type of operation contracted and the customer's history. In credit card invoice discounting operations, for example, the average rate was estimated at 12.7% per year in August 2024, while the average rate for working capital operations was estimated at 21.6% per year. The average rate for credit card installments for companies was 140%.

The above operations refer only to credit operations with free resources, where the conditions are agreed between the company and the financial institution. The range of credit options also includes directed credit, BNDES resources and special credit lines.

As we mentioned in the previous article, offering guarantees also affects the cost of credit. And herein lies another difficulty: not every small business owner has the collateral to seek out cheaper operations. In this case, one option may be to resort to guarantee funds, which supplement any guarantees provided by the company, acting as guarantor for the operation. Some examples of guarantee funds are FAMPE, offered by SEBRAE, and the Operations Guarantee Fund (FGO).

Evaluating all these possibilities is part of credit discipline and can reduce default rates in the small business segment, helping to expand the supply of resources to this segment. It is also up to companies - and consumers in general - to take ownership of their credit history, in the sense of understanding that the better their history, the better the conditions for contracting credit tend to be and ensuring that their data is part of the positive register. The evolution of this history can be monitored through credit bureaus and their range of products and services.

The challenge of increasing access to credit for small businesses involves financial education for companies, the use of more accurate credit assessment instruments with more databases that reflect the company's behavior in relation to credit. This path is the foundation for the credit-to-GDP ratio to grow in a sustainable way and translate into more economic activity, job creation and social prosperity.

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor