The financial health of Brazilians in 2024 and advances in the knowledge dimension

In recent years, the issue of financial education has been mobilizing society. This is in the wake of the process of “financial deepening”, which is understood as widening access to financial services. The aim of spreading financial education is to increase the well-being and financial health of people and companies, but has this actually happened?

The topic of financial well-being has gained ground in Brazil and around the world. Developing a definition of the term is one of the proposals of the Global Partnership for Financial Inclusion (GPFI), a working group linked to the G20. A document released by the OECD in November 2024 presents a preliminary definition and highlights the importance of a common framework for measuring financial well-being.

As the document shows, some initiatives have sought to define and measure actions around the world. In the United States, the Consumer Financial Protection Bureau (CFPB) presented a guide to building a financial well-being scale in 2015. This guide served as the basis, among other international protocols, for the creation of the Brazilian Financial Health Index (I-SFB), launched in 2020 by the Brazilian Federation of Banks (FEBRABAN), with the technical support of the Central Bank. The credit bureau sector took part in the discussions at the stage of developing and reviewing the indicator.

The most recent I-SFB data, for 2024, was released in October 2024. We comment in this space the data for 2023. Before presenting the latest data, let's remind ourselves of the definition of financial health, according to the Index's methodology. Financial health is defined as the extent to which an individual assesses that they are able to meet their financial obligations; believe they are able to make good decisions; have the discipline and self-control to achieve their goals; feel secure about their financial future; and have the freedom to make choices that allow them to enjoy life.

These perceptions are measured through 12 questions. The answers generate a score from zero to 100 and, based on this score, individuals are classified into categories. At the “good” level, with a score of 83 to 100 points, there is an indication of a life without financial stress, with security and freedom. At the other end of the spectrum, the “bad” level, with a score of zero to 36, indicates financial fragility and disorganization. Between the extremes, other ranges are defined, showing situations that are neither so good nor so bad. In the 57 to 60 point range, for example, there is an indication that finances are balanced, but on the edge.

What is the picture of Brazil, according to this methodology and definition of financial health? In 2024, the field survey was carried out between May 15 and July 29, with a sample of 4,911 cases. The average Brazilian score was 56.7 points, higher than in 2023 (56.2 points).

Beyond the portrait, it's worth looking at the film of the last year to identify what has improved, stagnated or even worsened in the different dimensions of the indicator. The percentage of consumers who said they had difficulty paying a bill fell by 2.2 percentage points. The percentage of those who said they were struggling (-1.5 p.p.) and those who said they spent more than they earned (-1.5 p.p.) also fell. On the other hand, the percentage of consumers who said they knew how to control themselves so as not to spend too much rose (+2.2 p.p.) and those who reported having money left over at the end of the month (+1.3 p.p.).

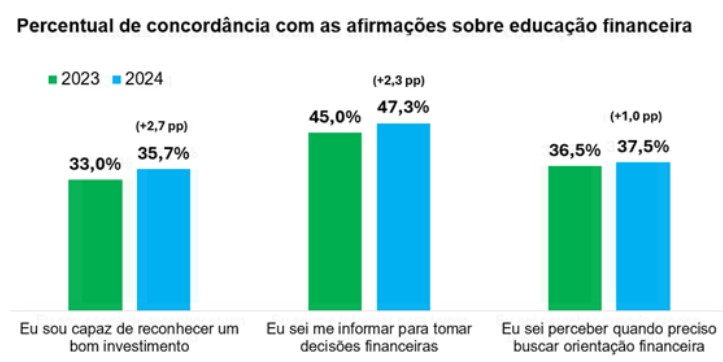

In the questions that directly measure financial education, the index also showed progress. The percentage of those who said they had the knowledge to recognize good investments grew by 2.7 percentage points. The percentage of those who said they knew how to inform themselves in order to make good financial decisions and those who could tell when they needed to seek advice also grew.

However, there is still room for improvement in Brazilians' financial health. Only 32.41% said they could cope with a large unexpected expense - a percentage that was practically stagnant compared to 2023. Looking to the future, 67.2% said they were unsure about their financial future.

More than just indicating the financial health of Brazilians by calculating a national average, the I-SFB is available for consumers to calculate their own index and obtain a diagnosis. This assessment can be enriched with knowledge of the credit score, which can be consulted through credit bureaus free of charge. This information is becoming increasingly important for credit analysis and knowing how to use it and what it is used for is an important dimension of financial knowledge.

In short, the figures show that the work of disseminating financial education is producing results and must continue, so that consumers make the best use of financial instruments based on knowledge. The credit bureau sector continues to invest so that this scenario evolves, enabling people and companies to prosper and the economy to grow.

Thanks for reading! Access other content at ANBC website.