With 62% Brazilians registered, Cadastro Positivo proves its potential for financial inclusion by inserting around 4 million people and companies into the credit market

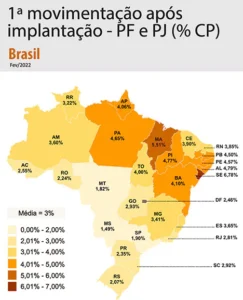

Data released by ANBC shows the percentage of the population that benefited from the first credit consultation after the implementation of the Positive Registry with automatic adhesion

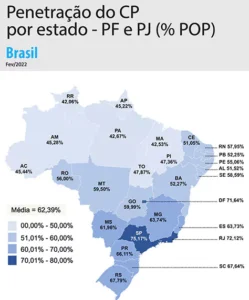

São Paulo, April 13, 2022On the verge of completing three years of its automatic adhesion model, the Cadastro Positivo currently has 62% of the Brazilian population in its database. São Paulo (75%), Rio de Janeiro (72%) and the Federal District (71%) top the list of states with the highest participation in the database. The data was released by the National Association of Credit Bureaus (ANBC) and which considers both individuals and companies.

The survey also proves the initiative's potential for financial inclusion: of the total number of consumers and companies in the country included in the database, 4 million benefited from credit consultations after the new law came into force. Positive datain July 2019 - which is equivalent to around 3% of entrants.

In terms of states, the Northeast region stood out. Sergipe registered the highest rate of newcomers to the credit market, with 6.78%, followed by Maranhão (5.51%) and Alagoas (4.79%).

"In these almost three years, the Positive Registry has been confirming the benefits foreseen in its implementation, especially in relation to financial inclusion. This data proves how the Positive Registry can change the reality of those looking for credit. These 4 million consumers and companies who have been included in the financial market since the first consultation have become visible in the credit market due to the Positive Register, says Elias Sfeir, president of ANBC.

According to the executive, consumers and companies that already participated in the credit market have also benefited from the Positive Registry.

"The empowerment of the borrower, made possible by the credit score calculated taking into account positive data, can result in better conditions for loans and financing, allowing credit to be taken without jeopardizing payment capacity, which reduces defaults, impacting the banking spread and benefiting the economy," he adds.

Financial inclusion

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor