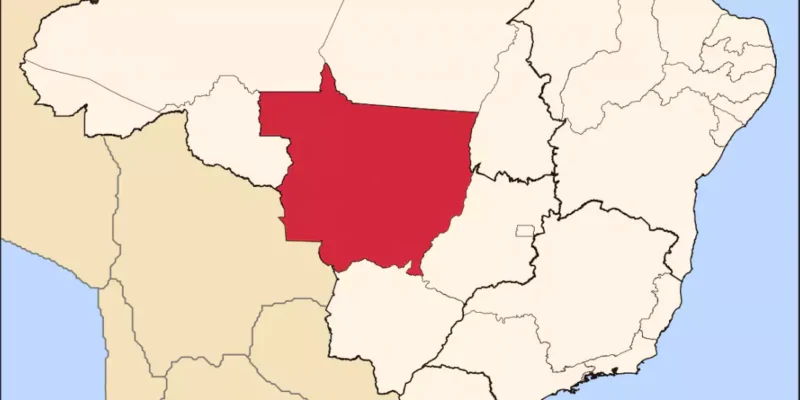

Valid as of July 9, the new Positive Registry could inject R$ 20 billion into Mato Grosso do Sul's economy

The measure should include 566,000 consumers in the state in the credit market

Mato Grosso do Sul, June 18, 2019: The new Cadastro Positivo model, which comes into force on July 9, could inject R$ 20 billion into the Brazilian economy. Mato Grosso do Sul and provide access to credit for an additional 566,000 consumers, which represents around 20% of the population. The figures are part of the breakdown, by state, of a study carried out by the sector at the request of ANBC (National Association of Credit Bureaus), which also concluded that, in Brazil, the new CP has the potential to bring up to 22 million consumers into the credit market, as well as more than R$ 1.1 trillion into the national economy.

According to the expanded survey, Mato Grosso do Sul, with 39.5% of defaulters, has a lower rate than the Brazilian average, which is 40.3%. And like the rest of the country, the new Positive Registry is likely to reduce defaults in the state by up to 45%.

This tends to happen because the new CP will promote the automatic inclusion of all consumers, form a payment history for each citizen, whether it's credit received or ongoing services (water, electricity, gas and telephone), and establish a credit score based on this history. In other words, the model values payments made, positive data - and not just any unpaid or overdue debts.

Comparative figures:

“The addition of more people to the credit market, the expansion of credit for those already in the market and the reliability of the credit rating as a basis for granting credit have the potential to lower interest rates on loans and financing,” observes Elias Sfeir, president of ANBC. He adds that the main benefits are social because there will be a reduction in defaults due to fairer interest rates and because stimulating the credit market is fundamental to boosting local economies and creating jobs.

Another point to highlight in relation to the new CP is the improvement in credit for classes C, D and E. According to Sfeir, the positive registration increases the credit rating for around 60% of this population.

ANBC Press Relations

Regina Pimenta: (11) 98136.6835 regina@pimenta.com

Ana Carolina Rodrigues: (11) 98674.0348 anacarolina@pimenta.com