Labor market data recently released by the IBGE show that the unemployment rate fell to 6.2% in the 4th quarter of 2024, reaching the lowest value in the historical series, which began in 2012. Drawing a parallel with the good credit performance seen over the last year, it is possible to say that this improvement is partly due to the favorable employment situation.

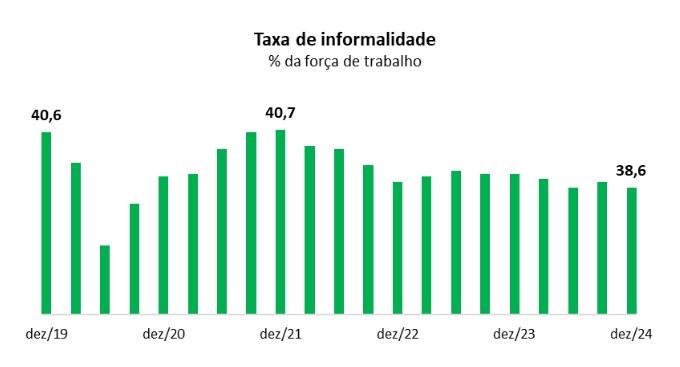

However, there are different realities in the universe of the employed population. This contingent, which includes public and private sector employees, employers and self-employed workers, can be divided into the formal and the informal. In the same period, the informality rate was estimated by IBGE at 38.6%, which is equivalent to 40 million Brazilians.

For comparison, estimates from the International Labor Organization [AG1] point out that the global informality rate will reach 58.2% in 2024, being higher in low-income countries, where it was estimated at 88.5%, and lower in developed countries (13.5%).

Informal workers include employees without a formal contract and self-employed workers without a CNPJ. Although the informality rate has decreased since its peak in 2021, this number remains high, which represents a significant concern for the credit market.

This is because employment is a crucial variable in predicting the repayment capacity of those applying for a loan or financing. In the informal sector, even when the credit applicant has a good income, it is more difficult to prove, leaving room for information asymmetry.

This is where the credit bureau sector comes in, using data and intelligence to address this asymmetry. However, informality brings with it other risks. If the informal worker loses their ability to work, their income becomes vulnerable, without being able to count on a social safety net. On the other hand, formalizing a job makes it easier to prove income and provides access to protection in the event of unforeseen circumstances, thus reducing credit risk. The negative relationship between informality and the degree of development of the financial system is well established in economic literature. In fact, countries with more advanced financial systems tend to have lower informality rates. An article published by the World Bank explores the causal relationship behind this association. The question posed by the study is: can the presence of a robust financial system encourage formalization?

The answer is positive. According to the article, expanding access to financial services encourages productive investments, increasing the scale of business operations and stimulating formalization. A tangible example in Brazil was the creation of the PIX, which opened the doors of the financial system to millions of Brazilians, especially informal ones. Once "banked", many of these people will be able to start their journey towards formalization, facilitating access to more complex financial services, such as credit and insurance.

Of course, the development of the financial system is just one of the factors driving formalization. Tax simplification and the reduction of bureaucracy in the process of starting a business are also vectors that stimulate the formal economy. In addition, it is necessary to consider the reality of the transformations in the labour market in Brazil and around the world, with so-called "platformized" workers, i.e. those who carry out their professional activities through digital platforms, such as delivery or transport apps.

As you can see, the benefits of developing the financial system go beyond formalization, as they also have an impact on companies' propensity to invest and increase their productivity. The relationship between the credit market and economic development is intrinsically linked to the formalization of economies. These transformations are underway in the Brazilian credit market and deserve attention from both the public and private sectors.

I invite you to reflect on this topic and share your experiences and insights. Together, we can contribute to an even stronger and more productive Brazil!

Thanks for reading! Access other content at ANBC website.