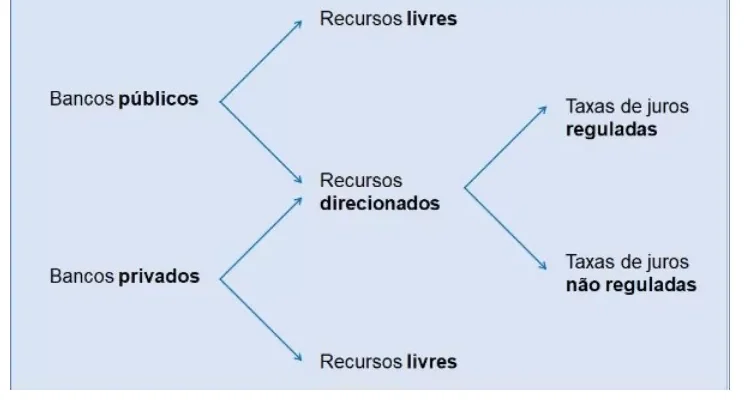

A particular feature of the Brazilian market is the strong presence of so-called “directed credit”. Often confused with subsidized credit, this category includes, in addition to regulated rates, resources with rates agreed between financial institutions and borrowers.

What defines directed credit and differentiates it from “free credit” is that directed operations are regulated by the CMN (National Monetary Council), use specific funding sources and are aimed at financing sectoral activities, such as real estate, rural and infrastructure. There are two types of targeted credit: regulated and unregulated interest rates. With interest rates generally higher in the free credit segment, directing resources has been the way the Brazilian market has found to finance medium and long-term activities, including the promotion of some sectors of the economy, especially in directed credit with regulated interest rates.

The graph below shows the evolution of the share of directed credit in the total credit balance. It can be seen that since 2011, directed credit has accounted for between 38% and 50% of the total credit balance in Brazil, with the highest level being observed between the end of 2015 and the beginning of 2018. According to the latest Central Bank of Brazil, In July 2023, the share of directed resources reached 41.2% of the total credit balance.

The analysis of the allocation of resources by segment shows that the volume of directed credit represented 44% of total credit to individuals in July of this year, with real estate financing being the most important directed modality. As for credit to companies, directed credit accounted for 36% of the total, with financing via BNDES (National Bank for Economic and Social Development) the most important modality.

It's worth asking how this significant slice of the Brazilian credit market compares with free credit in terms of defaults and interest rates. In credit lines with free resources, the average default rate - arrears of more than 90 days, according to the Central Bank's criteria - was around 5% in July, while in directed credit the average rate was 1.7%. The average interest rate was 44.3% for free credit and 11.6% for directed credit in the same period. In addition to the rate, the payment conditions for subsidized credit are more favorable to the borrower.

That's the extent of directed credit in Brazil. Too much or too little? This question is more difficult to answer, not least because it is specific to Brazil. Data recently presented by the Central Bank shows that the presence of directed credit in other countries is lower, and one of the highest percentages of directed credit is seen in Mexico, with around 26% of the credit balance being directed, while China has around 2%. These figures are well below those observed here.

We have already discussed in this space the importance of directing resources to rural credit, considering the risks inherent in this activity. Conceptually, targeting resources with subsidies can be justified in the case of economic activities that generate positive externalities. In the case of information asymmetries that create barriers to access to credit and sectoral promotion, it is justified to direct resources at rates that can be freely agreed upon.

Excessive targeting can, however, cause distortions in the allocation of credit, affecting the real economy, since the credit market, as it were, sorts out investment projects. In the debate about the factors that explain Brazil's high interest rate, one of the reasons pointed out is the volume of resources directed - in particular, the subsidized part. The economic logic is as follows: the greater the volume of subsidized credit, the higher the basic interest rate must be in order for monetary policy to reach a certain inflation target. On the other hand, we have the promotion of sectors that are fundamental to encouraging economic activity, contributing socially to the country.

As part of the credit ecosystem in Brazil, the bureau sector has followed and reported on the evolution of credit in the country, as well as the agenda for modernizing this market. The sophistication of credit analysis instruments and the consequent reduction in informational asymmetry tackle the two factors that contribute to the high weight of credit steering in Brazil: the cost of and barriers to access to credit. The across-the-board reduction in the cost of credit could favor the free credit segment, while at the same time allowing for more focused targeting policies.

Thanks for reading! Access other content at ANBC website.

President of ANBC - National Association of Credit Bureaus. Representative of Latin America in the World Bank Credit Committee. He also represents Brazil and Latin America in credit organisations accross the world, such as ACCIS, BIIA and ALACRED.