In August 2025, a research carried out by PwC and the Brazilian Digital Credit Association (ABCD) has updated data on the participation of so-called “fintechs” in the Brazilian credit market. “Fintech” is the term used to describe companies that operate in the technology-intensive financial services segment. These services include credit, payment, insurance and investment solutions.

According to the data presented in the report, the total value of loans granted by fintechs reached R$ 35 billion in 2024, up 68% on the previous year. The segment's customer base is also expanding at significant rates. According to the survey, the number of individuals reached 67.5 million, up 26% on the previous year. The corporate customer base reached 55,000, an increase of 67%.

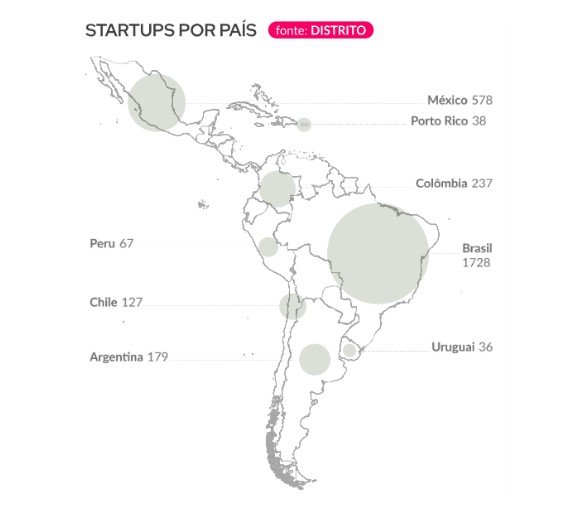

On the global scene, data collected by Statista, The latest figures, from May 2024, show a total of 30,000 fintechs in the world, of which 3,500 are in Latin America and around 1,700 are in Brazil, which leads the ranking in the region. The regions with the highest number are North America and Europe. Complementing this data, the Distrito's Fintech Report 2025, provides a map with quantities by Latin American country.

The presence of these institutions in the credit market is recent. In April 2018, Resolutions 4,656 and 4,657 of the National Monetary Council created two categories of credit fintech: Direct Credit Companies (SCD), which use their own capital to grant loans, and People-to-People Lending Companies (SEP), which act as an intermediary platform connecting investors and borrowers. The aim of the regulation was to increase competitiveness in the credit market, making room for a reduction in interest rates.

Seven years after the publication of the resolutions, fintechs are beginning to enter a new stage of maturation. One of the main strategies adopted by fintechs to maintain the sustainability of their operations, according to the survey, is the growing offer of credit with guarantees of various kinds, such as assets, receivables, financial investments, among others. The percentage of companies accepting assets as collateral reached 77% in 2024. In this trend, the use of cell phones as collateral is also growing.

However, the segment faces some challenges. In the individual segment, the default rate reached 9.5%, higher than the average for the National Financial System, which was 3.5% in 2024, according to data from the Central Bank.

The higher default rate among fintechs is the result of their own expansion, which involves a higher risk profile. In addition, these companies have a leaner credit recovery structure. According to the PwC and ABCD report, In the Corporate segment, the default rate fell from 5.3% in 2023 to 3.4% in 2024. Looking at the National Financial System as a whole, it can be seen that defaults rose throughout 2025. The most recent data from fintechs is yet to be released and it will be important to assess the behavior of this segment's arrears against the general backdrop of rising defaults.

Finally, the study mentions the importance of adopting credit analysis technologies to reduce the interest rates charged by fintechs. The bureau sector continues to strive to improve its models, mitigating the risk of default through information. And in the wake of digitalization, completing the credit journey, the sector has platforms that make it easier to identify arrears and settle them. Used across the entire ecosystem of the financial industry, technology is showing its potential to make the credit market more competitive and efficient.

Thanks for reading! Access other content at ANBC website.