Duplicatas are a typically Brazilian instrument, created by commercial practice and incorporated into the legal system over time. Their origins can be traced back to the beginning of the 20th century. Even after decades of use, duplicatas maintain their importance for commercial relations, with adaptations that reflect the state of technology and the search for efficiency. One of the most recent developments has been the formalization of the electronic duplicata.

Conceptually, a duplicata is a credit document drawn up from the sale of a good or the provision of a service to prove the existence of the debt between the supplier (in the jargon, called the drawer) and the buyer (drawee). The issuance of this document is governed by Law 5.574 of 1968.

Duplicatas can be traded on the financial market, making it possible for the creditor to anticipate the flow of receivables, and they can be used as collateral in loan operations. In addition to financial institutions, the market has companies specializing in factoring operations, also known as "fomento mercantil".

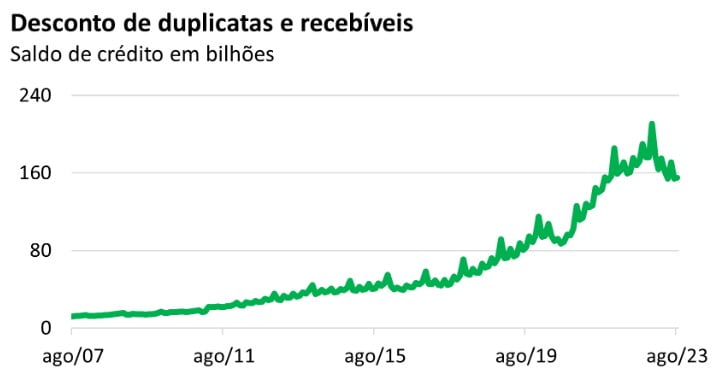

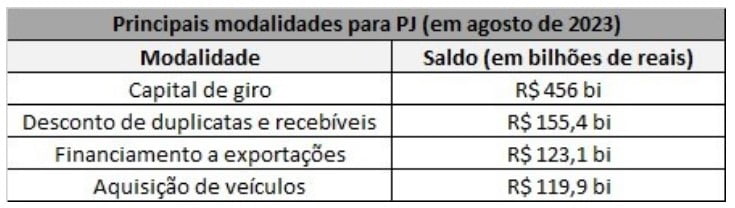

Data from Central Bank of Brazil show that the balance of operations in the form of discounting trade bills and receivables reached R$ 155.4 billion in August 2023, which represents around 11% of the balance of credit to legal entities with free resources. Among these modalities, discounting receivables and trade bills has the second largest balance, behind working capital.

Even with this significant volume of operations linked to receivables, the financial industry was calling for the modernization of duplicatas, seeking to adapt this instrument to the reality of digitalization and, consequently, make it easier to verify the quality of the securities. One of the difficulties is the uncertainty about the veracity of the duplicatas presented, given the irregular issuance of cold duplicatas, i.e. without the counterpart of a sale or provision of a service.

In receivables prepayment operations, this uncertainty translates into an increase in the risk of the credit operation and, consequently, the cost of credit. Seeking to modernize this instrument, Law 13.775 of 2018, instituted book-entry duplicatas, to be issued by bookkeeping entities authorized to operate by the Central Bank.

Since the approval of Law 13.775/18, regulatory bodies and private entities have been working on developing the infrastructure and regulatory details for issuing these securities. In August 2023, another step was taken in the regulation of electronic duplicatas, with the publication of the BCB Resolution 339The new law, which establishes rules for the operation of electronic duplicate bookkeeping systems. The expectation is that, with the centralization and publicity of information, electronic duplicates will be able to curb the occurrence of fraud.

The benefits, however, go much further. We know that information is an important asset in the credit market. For decades, the credit bureau sector has been working to transform data into information that guides decision-making. In this sense, the centralization of duplicate invoice information creates yet another source of timely and reliable data, which allows the sector to enrich its analysis of companies' profiles based on financial flow data.

Combining this data with other sources of information from the bureaus allows for a better assessment of companies' creditworthiness, improving the interest conditions and terms under which credit is approved. This applies to both suppliers and drawees in commercial transactions. In addition to advancing the predictive capacity of the analysis, the integration of information relevant to credit speeds up the analysis process for granting institutions and companies.

The Brazilian market has been moving in the direction of increasing access to information and improving its quality. Despite the limitations of legislation more than half a century old, the volume of commercial development is significant, as shown by Central Bank data, and could reach an even higher level, favoring cash flow management for companies, especially micro and small ones.

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir

President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor