Default and renegotiation between companies

Running a company poses a number of challenges. You have to deal with market changes, economic fluctuations and business regulation. As a result, it is common for some companies to face financial difficulties. This article presents the evolution of defaults among legal entities and ways of regaining full access to credit.

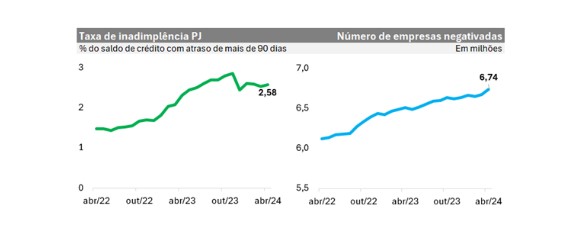

According to data from credit bureaus, the number of companies with negative credit ratings grew from 6.66 million in January 2024 to 6.74 million in April of the same year. Extending the horizon of analysis, it can be seen that this number is growing almost continuously, with the exception of the beginning of the pandemic, when there was an incentive to renegotiate debts.

The majority of this contingent of negatived companies are micro and small businesses. This reflects the fact that the number of active small businesses is much higher than the number of large companies. Looking at the evolution of the number of companies that have been denied credit, we see a growth of 1.7% among small businesses and 1.3% among large companies. Denial of credit is an important instrument because, on the one hand, it mitigates the risk of credit providers and, on the other, it avoids the risk of credit default. over-indebtedness of debtor, signaling the need for adjustments.

Another important indicator of delinquency is calculated by the Central Bank and relates only to bank debts. While the data from the bureaux sector counts the number of companies on the lists of those who are in default, the data from the Central Bank calculates the percentage of the balance of credit to companies, obtained through the National Financial System, which is more than 90 days overdue. This data also confirms the advance of the default phenomenon in the post-pandemic period, with a stabilization in recent months. This indicator went from 2.16% in February 2020 to 1.20% in March 2021, reaching an all-time low in the midst of the pandemic. In the most recent calculation, in April 2024, the rate of default among legal entities reached 2.58%.

In the face of default, how do you proceed? The bureau sector provides information on the CNPJ itself, highlighting the credit score and its evolution. This score reflects the company's credit behavior. In addition, it is possible to consult any notes on the CNPJ. CNPJ information is particularly important for small businesses, which often have less structured finance departments than large companies. Individual micro-entrepreneurs, who make up an increasing number of companies, can also access these same resources. The possibility of monitoring the evolution of the credit rating also creates an incentive for punctual payments, since companies with a good credit history can request fairer conditions when applying for credit.

If the company notices any delays and/or non-payments, it should identify the causes of the financial imbalance - for example, market reasons, such as increased competition, cyclical reasons or cash flow - and seek to renegotiate the debt, based on realistic assumptions about the company's ability to pay. In general, the problem of default is usually more than just a one-off issue, reflecting deeper financial and operational difficulties. Proof of this can be seen in the figures for repeat defaults: according to data released by the bureau sector, seven out of every ten companies that were delinquent in May 2024 were already on - or had been on - the delinquent lists in the previous 12 months.

There are several ways to start renegotiating, either through direct contact with the creditor or through the bureaux sector, which offer platforms to facilitate this process.

The Desenrola Small Businesses program was recently launched with the aim of encouraging renegotiation among companies that earn up to R$ 4.8 million a year and have debts with financial institutions. According to the most recent information released by FEBRABAN, As of July 2, more than 42,000 companies have benefited from Desenrola. The volume renegotiated has already reached R$ 2.5 billion.

Recovering debts allows companies to return to the credit and capital market and find resources to ensure the business runs smoothly and invest in improvements. Financially healthy companies preserve jobs and create new ones as their businesses grow. Well-used credit is one way of doing this.

Thanks for reading! Access other content at ANBC website.

President of ANBC - National Association of Credit Bureaus. Representative of Latin America in the World Bank Credit Committee. He also represents Brazil and Latin America in credit organisations accross the world, such as ACCIS, BIIA and ALACRED.