Over-indebtedness is a chronic problem in Brazil, with consequences for financial and even social life. This problem also affects credit conditions, since it increases the risk perceived by financial institutions. For this reason, the approval of Law 14.181/2021, of July 2, 2021, called the Over-indebtedness Law, This was an important step towards disciplining credit in the country, as part of a broader set of rule changes aimed at making this market more efficient.

The main aim of the law is to protect people who have taken on too much debt and can only pay it off by compromising their basic needs. Based on the assumption that people in a situation of over-indebtedness need special protection, the law seeks to guarantee consumers mechanisms for equalizing and renegotiating their debts by means of payment plans that preserve the rights of creditors and at the same time enable consumers to pay all their debts, due and owing, without compromising their “existential minimum”.

The concept of the “existential minimum” exists in the main developed countries. In general, it refers to the amount necessary for a person to meet their basic needs, such as food, housing, sanitation, energy and health care. The values and criteria for determining this are specific to each country. In England, for example, the amount depends on various factors, such as the age of the claimants, whether they live alone or with a partner and whether they have children. In Portugal, the so-called subsistence minimum also varies according to the size of the family, the number of children and other specific circumstances.

In Brazil, the existential minimum is a value that is currently set at R$ 600.00.

In short, the legislation to prevent over-indebtedness is a step forward, as it makes it possible to collectively negotiate debts between individual debtors and their creditors in a fair way, in an attempt to reduce defaults and improve the credit environment in the country.

Over-indebtedness and Default

Data from the sector shows that the number of consumers in default remains high, at around 45% of the adult population. The breakdown by age also shows that in the 30 to 39 age group, almost half of consumers are in default.

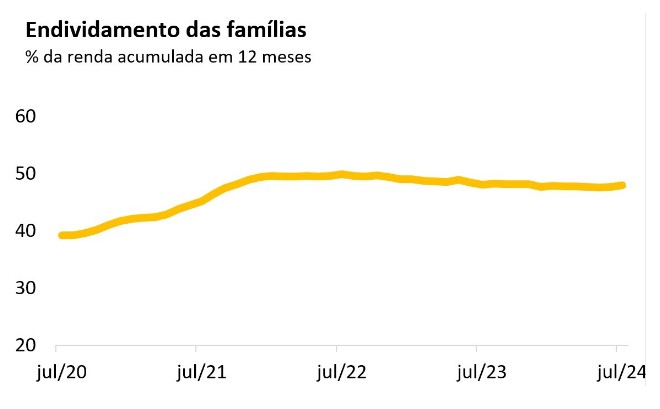

The indebtedness indicator, which measures the commitment of household income to credit operations, reached record levels according to the Central Bank - almost 50% at the beginning of 2022, but has been slowly declining since the second half of that year.

The data deserves deep reflection, because the increase in defaults has a negative impact on everyone. This is because it compromises companies' cash flow, damages the performance of the economy as a whole and ends up penalizing the credit borrower himself, who ends up being shut out of the market.

The good news is that reducing indebtedness has earned the attention of legislators and governments. In addition to the raising of the existential minimum in March/2023, the Desenrola program was recently concluded, benefiting around 15 million Brazilians.

Another piece of good news is that financial institutions are becoming more involved every day in improving advice, guidance and transparency in their relationship with their clients. It is essential that the offer of credit is made responsibly and that the rules contained in Febraban's self-regulation on advertising and offers, transparency on costs, risks and deadlines remain valid. What's more, the practice of sending warnings to consumers when taking out credit could compromise the value of the existential minimum should be encouraged.

11 tips to avoid over-indebtedness when taking out credit

Here are some general suggestions for avoiding over-indebtedness. It's important to check which ones make sense for your specific financial situation. If you think it's appropriate, seek the advice of a qualified financial professional for personalized advice.

1. Organize your accounts and analyze your ability to pay before applying for credit: write down all your income and expenditure. Knowing your monthly income and expenditure will be important if you want to draw up a realistic budget and have a clear view of the resources that will be available to pay off your debts. Take into account the amounts and due dates of outstanding bills, as well as the interest embedded in or applicable to the debts. This can help you “swap” expensive debts for other forms of credit with lower interest rates.

2. Loans or credit cards: Compare interest rates and payment conditions before choosing a credit card or taking out a loan.

3. Avoid overdrafts and credit card revolving accounts: these are easy to take out and have the highest interest rates. So be careful: avoid using the full limit of your card and pay the full amount of the bill on time. Also with regard to your card: never lend it to third parties or family members. There is a high risk that you will end up paying off the debt on your card. The same applies to loans: avoid taking out credit operations in your name, especially payroll loans, to provide funds to friends and family. In these cases, the bill will almost always end up being paid by the person who took out the loan - you.

4. Make rational purchases, bet on conscious consumption: avoid buying superfluous items as much as possible if this compromises the balance of your finances. The focus should be on paying for the expenses you have already incurred and your current living expenses, consumer bills, food, medicines and hygiene and cleaning products. Beware of offers of easy credit or purchases in installments over long periods without interest. The interest is already built into the monthly installments.

5. Control your installments: before making a purchase in installments, make sure that the installments fit into your monthly budget. Avoid excessively long installments, as they can compromise your ability to pay in the future.

6. Assess the real need and research credit options: before applying for credit, think carefully. Assess whether it really makes sense to take on yet another obligation. Avoid taking out loans for superfluous expenses or expenses in general. Even so, if you do decide to take out credit, compare the different options and modalities available on the market, analyzing interest rates, payment terms and general conditions.

7. Avoid accumulating debts: master the art of curbing impulses. Avoid taking out new loans or financing while you are still paying off previous debts. Avoid getting into a cycle of debt that is difficult to get out of. And don't take out loans to pay off other loans or debts, except in the case of longer terms and lower interest rates.

8. Renegotiate your debts: when facing financial difficulties, be proactive: get in touch with your creditors right away and negotiate more favorable payment terms that better fit your budget.

9. Emergency fund: keep a financial reserve to avoid resorting to credit in emergency situations. Save whenever possible, no matter how small the amount. This will help you keep control of your finances. Start saving money today and benefit from the “magic effect” of compound interest.

10. Financial education: it is a widely recognized fact that in order to have a healthy financial life it is essential to know how to deal with money. For example, by avoiding waste and cutting expenses, you can save, economize and invest. Improving your knowledge of money management, investments and financial planning will make it easier to manage your debts and avoid over-indebtedness.

11. Avoid waste and generate resources to save: influencers and financial planners are unanimous in saying that, with simple changes in habits, it is possible to make room in the budget to save - and avoid over-indebtedness. To do this, take a close look at each type of expense and see if there is room for savings while maintaining quality of life. Remember: always think in annual terms.

And finally, an important tip: in addition to combining balance and wisdom when it comes to spending, it will be great if you can expand your sources of income and thus increase your ability to save. These actions remove the risk of over-indebtedness and contribute to your financial freedom.

Thanks for reading! Access other content at ANBC website.

By: Elias Sfeir President of ANBC & Member of the Climate Council of the City of São Paulo & Certified Advisor