Credit and default

The delinquency data often released by the credit bureau sector allows us to analyze this phenomenon by age group. The openness of the information invites some necessary reflections. Considering the population as a whole, around four out of every ten Brazilians over the age of 18 entered 2025 with a bad name

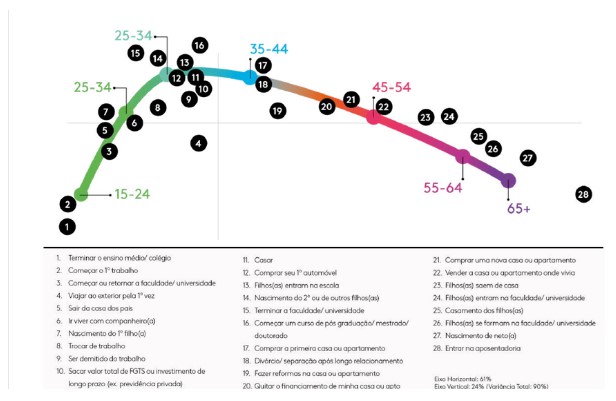

What we see is a high concentration of people aged between 25 and 50.

After all, what leads half of Brazilians of this age to default? And how can we prevent younger people from repeating this pattern?

To better understand the phenomenon, it is important to understand the economic and social challenges that the generations face.

The Arc of Life maps these events:

The 30s are increasingly the time when people leave home and this change is becoming more frequent in the 25 to 34 age group. Leaving the parental home means taking on new financial commitments. In addition, this is the time when a professional career is being built and rarely corresponds to the peak of salaries, while the 35 to 44 age group is impacted by the purchase of their first property.

It's in the accumulation of these commitments that many people lose their way and end up in default. The delinquency data also shows that in the older age groups, the percentage of people in default decreases, reflecting the stabilization of their professional and, consequently, financial lives. Among younger people, aged between 18 and 24, there is a lower default rate of 28.9%, reflecting the fact that access to financial services is more limited in this age group.

The 18-24 age group includes the so-called Z generation, born between the mid-1990s and 2010. Although it is smaller than in the general population, younger people's access to financial services has been growing in recent years. According to the World Bank's Global Findex, the percentage of young people aged 15 to 24 with a bank account more than doubled between 2011 and 2021, from 36.3% to 79.9%. Credit card ownership went from 32.5% to 70.1%. It's very likely that, for the youngest of this generation, the first and only known form of money transfer was the PIX and that banking takes place through a screen.

Thanks to increased access to financial services, younger people are likely to reach their 30s with more time using these services than previous generations, for better or worse. This is because the financial relationship history that these young people are building has an increasing weight in credit analysis. Impulsive use of credit today could jeopardize access to credit tomorrow, precisely at a stage in life when it is more common for people to seek financing.

Thinking about the future of credit, it is essential to guide this public, who are about to take on the commitments of independent life, so that they have a healthy relationship with credit and greater well-being. The dissemination of financial education, which is increasingly present in schools, is a great ally in this process.

Young people need to be taught from an early age about the importance of systematic financial control and how planning helps to build up a financial reserve. In addition, it is valuable to know the characteristics of each financial and credit product, in order to make efficient use of these services. Data from a study by the Central Bank on the long-term impact of financial education shows that among young people exposed to this knowledge during school, the likelihood of default years later was lower than among the rest, as we have already reported in this space.

The importance of financial guidance also applies to older people, especially those who are in the negative debt statistics. The beginning of the year is a good opportunity to reorganize finances, set goals, define priorities and, in the event of arrears, seek to renegotiate debts. A good way to start is by diagnosing your financial life and checking your credit rating through the credit bureaus.

The evolution of defaults depends on conjunctural variables, such as income, and behavioral factors. The economic situation can change quickly. Changes in behavior and the assimilation of good financial habits, on the other hand, take time. Hence the need to invest in financial training for young people, so that they take good practices into adulthood and establish a healthy relationship with credit.

Thanks for reading! Access other content at ANBC website.