Source: Economic Movement - 06/04/2025

“The abusive and illegitimate litigation of the ‘clean name’ industry is a threat to the credit market,” says ANBC president

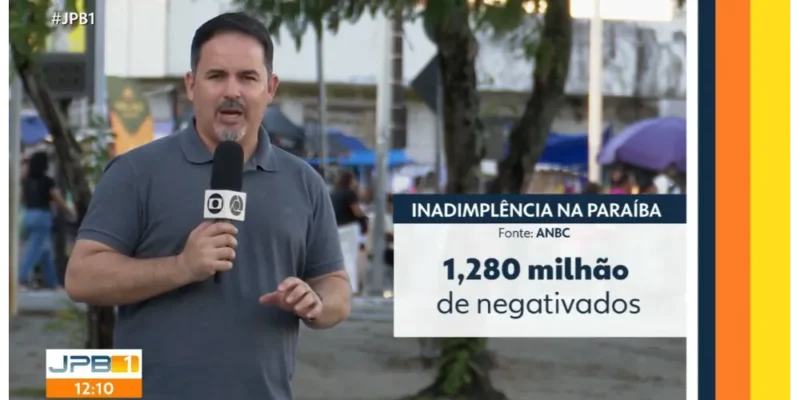

The National Association of Credit Bureaus (ANBC) has sounded the alarm about the negative effects of abusive litigation on the credit market in Brazil. The inappropriate use of the judicial system, through repetitive lawsuits and with the aim of delaying decisions, has generated distortions that affect both the supply of credit and interest rates, with direct impacts on consumers and financial institutions.

“One manifestation of abusive litigation is the ‘name clearing’ industry, which directly interferes with the information system that underpins the credit decisions of thousands of institutions, both inside and outside the financial system. When there is an excess of illegitimate lawsuits, everyone suffers: from the plaintiff himself, who can fall into over-indebtedness, to other consumers, who face higher rates and less credit on offer,” says Elias Sfeir, executive president of ANBC.

The practice, which is often aimed at excluding default records, has become a model of action that benefits the few to the detriment of the many. The growth in the number of lawsuits also puts pressure on the judicial system, consuming time and public resources. Data from the National Council of Justice (CNJ) indicates that, in 2023, the country had 83.8 million pending cases. It is estimated that around 30% of civil lawsuits in state courts involve abusive litigation.

A study carried out by the Central Bank of Brazil, based on the period from 2013 to 2018, shows the effects of this practice on the economy. According to the analysis, an increase of 10% in the proportion of court decisions favorable to debtors reduced the growth of new credit agreements by 23 percentage points.

“This evidence reinforces the importance of legal certainty for a healthy credit market. Clear laws and less discretionary interpretation of disputes are essential to avoid distortions,” adds Elias Sfeir.

Despite the risks, Brazil has made progress in tackling the problem. The CNJ's own recommendations, such as numbers 127 and 159, seek to curb excessive judicialization and promote greater balance between the parties.

“We have a robust credit information system that is well evaluated internationally. The abusive and illegitimate litigation of the ‘clean name’ industry is a threat to this vital mechanism, but the dialog between the judiciary and the private sector has generated positive results,” says the ANBC president.

Read more

Clarify your doubts about the Positive Register, FAQ click here.