Survey shows that after two years of the Positive Registry, 62% of consumers now know what a credit rating is

A survey by the National Association of Credit Bureaus (ANBC) also reveals the level of interest in the subject of “financial education”

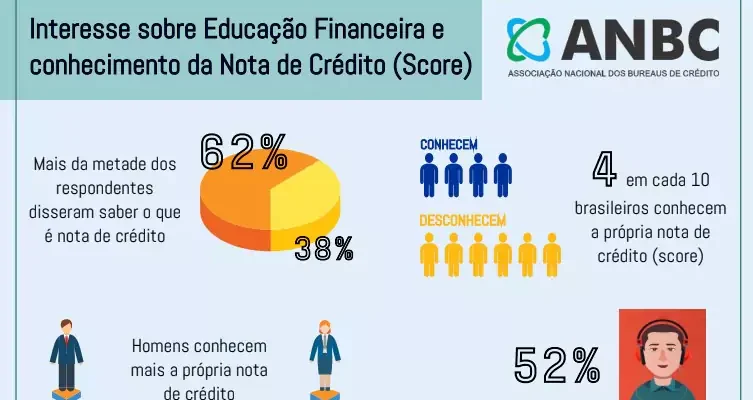

São Paulo, June 29, 2021: A survey conducted by the National Association of Credit Bureaus (ANBC) with 1,015 consumers reveals that, in about two years of using the Positive Registry, more than half of those interviewed (62%) already know what a credit score is, while 38% say they still don't know.

The survey, which was carried out in April and will be updated quarterly, aims to assess Brazilians' interest in financial education, their knowledge of credit scores and how important they consider this indicator to be for their financial lives.

Knowledge of the credit score

Of all those interviewed, it was found that only 4 out of 10 consumers (44%) know their own credit score, compared to 56% who do not. By age group, the youngest, aged between 24 and 35, are the ones who know the most about their credit score (52%). And men (48%) know more about their credit score than women (40%).

Of those interviewed who know their credit score, 84% consider it to be important for their financial life. This figure rises to 88% among women and falls to 82% among men. By age group, those aged between 46 and 59, with 92%, value this information the most.

The survey also found that, among consumers who are aware of the indicator, 82% are in the habit of following the evolution of their credit rating to find out if they can get credit on the market (37%), as a form of financial control (28%) and to have an image of being a good payer (23%).

In the opinion of Elias Sfeir, president of ANBC, “this movement that is beginning to be noticed among consumers, of recognizing the importance of the credit note and following its evolution, confirms its educational character and encouragement for more and more consumers to take control of their financial lives”.

Organization and control of finances

Aware that consumer interest in financial education is a prerequisite for the development of the Brazilian credit market, the ANBC survey gathered information on how respondents manage their personal and household finances and whether they are in the habit of controlling their household budget.

And it found that 86% are looking for information on how to better organize their personal and household accounts, while 14% admit they are not interested in looking for such information. By age group, it was found that the group that most seeks information is those aged 60 and over, and that men (88%) seek it more than women (83%).

With regard to budget control, 79% (8 out of 10 Brazilians) confirm this habit, while 21% ignore it. By age group, it can be seen that the group that practices budget control the most (80%) is those aged 60 and over, and that men (79%) are slightly more adept at budget control than women (78%).

According to Sfeir, the proposal to carry out this survey and make it permanent is yet another initiative by the sector to encourage good financial control practices and show the importance of credit assessment instruments for companies, interested in mitigating risks, and for consumers, interested in contracting credit under fairer and more advantageous conditions.

Methodology

Quantitative survey carried out using an online questionnaire between April 1st and 12th. The sample consisted of 1,015 respondents and, in order to read the general data, it is necessary to consider a 95% degree of confidence and a margin of error of plus or minus 3 percentage points.

ANBC Press Relations

Regina Pimenta: (11) 98136.6835 regina@pimenta.com

Ana Carolina Rodrigues: (11) 98674.0348 anacarolina@pimenta.com