It would be difficult to look back on 2022 without starting by remembering what the previous years were like. From 2020 to 2021, the world lived with the restrictions imposed by the pandemic. Thanks to the timely action of governments around the world and the strength of the financial system, economic recovery was rapid. In 2021, the GDP grew by 6.1% worldwide, while Brazil's grew by 4.6%.

For the global economy, 2022 began with the expectation that the recovery experienced in 2021 would continue. For Brazil, the scenario was less optimistic, with projections indicating GDP growth of less than 0.5%. Over the months, however, this picture has changed. Revision after revision, the projections now indicate an advance of 2.7% in Brazil's GDP. The trajectory of inflation has also turned out to be different from what was expected in Brazil and around the world, as a consequence of the conflict in Eastern Europe and the legacy of the pandemic.

The official inflation index exceeded 12% in the 12-month period ending in April 2022, but has been falling in recent measurements. Against this backdrop, the basic interest rate continued to rise, reaching 13.75% per year. Rising interest rates, as we know, mean more expensive credit. Even so, credit advanced throughout 2022 and at significant rates.

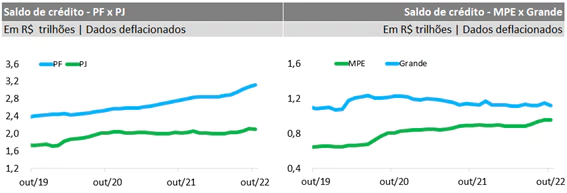

The most up-to-date credit data is up to October, but it already gives an indication of what has been happening in this market: the balance of credit to legal entities grew by 3.7% in the comparison between October 2022 and the same month of the previous year. Loans to families, on the other hand, rose by 12.5%.

Another important highlight, hidden among the general information, is that credit to micro and small companies continued to advance in 2022 and with growth above the average for the other segments. In September 2022, compared to the same month the previous year, the advance was 7.3%. This is an important result because it shows that the stimulus to the segment continues, even after the pandemic.

The graphs show the most recent evolution of the credit balance, according to data from the Central Bank. It can be seen that credit to individuals has grown faster than credit to companies. In the universe of credit to companies, credit to MSEs continues to grow, while credit to large companies remains stagnant, with a slight downward trend. It is clear to see that the difference between the balance for large companies and the balance for small companies has narrowed over the last few months.

A bank defaults, According to the monthly measurements of the credit bureaus, the number of people in default in the country, which was a concern at the start of the year, has started to rise. The sector's most recent estimates indicate that there are more than 68 million consumers registered on default lists.

These figures show the current picture of the Brazilian economy. We should also highlight some qualitative transformations that have been maturing over the course of this year and which could bring future results. These transformations are aimed at democratizing and competing financial services in Brazil, expanding access to the credit market for companies and consumers, without compromising the stability of the system.

The best example is the Cadastro Positivo. The National Association of Credit Bureaus (ANBC) released some figures throughout the year that confirm the potential of this instrument: according to the sector, more than 13 million people and companies have been included in the CP bases with the entry of companies in the telecommunications sector. Also noteworthy is the receipt of information from energy companies, which began last month.

Placed at the service of the credit market, the information of these consumers contributes to the “S” of the ESG tripod - an acronym that has also gained prominence throughout 2022 and which we have been talking about in this space - by shedding light on the so-called NoHolders, These are the people who need to be included socio-economically so that they can participate in the new economy or stakeholder economy.

In the field of financial services in general, we must mention the revolution in means of payment with the consolidation of PIX and the arrival of Open Finance, implemented in phases. Over the last few years, PIX has won over Brazilians and, in 2022, the model will be exported to other countries.

In short, the year after the crisis presented two cyclical moments: one of expected low growth and lower inflation; and another of higher growth and higher inflation. It's always a challenge to anticipate these fluctuations in the short term. Regardless, this year has also shown what the new normal is in the world of finance: increasingly digitalized services and competition driven by information technology.

In the next article, we will outline some perspectives for 2023, seeking to identify new challenges and opportunities in this new year.

Thanks for reading! Access other content at ANBC website.

President of ANBC - National Association of Credit Bureaus. Representative of Latin America in the World Bank Credit Committee. He also represents Brazil and Latin America in credit organisations accross the world, such as ACCIS, BIIA and ALACRED.