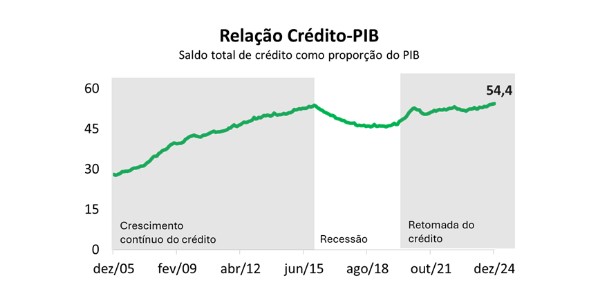

The credit-to-GDP ratio in Brazil ended 2024 at 54.4%, reflecting the growing importance of credit in the economy. But is this percentage enough? To understand, we need to look at the last 20 years and the contribution of credit bureaus to this progress.

In 2005, this ratio was just 28%. Since then, it has almost doubled, facilitating access to loans for consumers and companies. Credit bureaus have played an essential role in this growth, improving score models, reducing information asymmetries and increasing transparency.

Three major phases marked this evolution:

1* 2005-2015Accelerated expansion of credit, driven by innovations such as payroll loans and regulatory changes. Bureaus have expanded their databases, making risk analysis more precise.

2* 2016-2018Recession and credit restrictions. The bureaus helped to differentiate risk profiles, allowing credit to be granted more safely.

3* 2019-2024: Recovery driven by new programs and the use of the Positive Registry. Artificial intelligence and big data have become differentiators in credit analysis models.

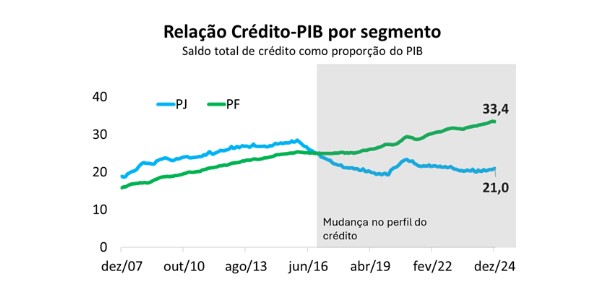

Changes in the credit profile Credit for Individuals (PF) exceeded that for Legal Entities (PJ). In 2007, PF represented 14% of credit-GDP, while PJ, 16.6%. In 2024, PF reached 33.4%, while PJ stood at 21%. This transformation was made possible by advances in credit bureau technology.

Global comparison Despite the growth, there is still room for more. While the credit-to-GDP ratio in Brazil stands at 71.6% according to the World Bank, the global average is 146.5%. In the US, it reaches 192% and in Chile, 109.5%.

The future of credit New regulations, such as the guarantees framework and the over-indebtedness law, will continue to shape the market. With the increasing use of alternative data on creditor behavior and predictive models, credit bureaus will continue to drive efficiency and access to credit in Brazil. Another major challenge being tackled by credit bureaus is the fight against fraud in order to make operations more secure.

Thanks for reading! Access other content at ANBC website.